Question. Discipline. Patience.

Investor Principles for Success

Investors big and small, sophisticated and simple, struggle to get the investment returns they desire. DALBAR and Associates and others have documented the performance shortfall for years, but few tangible solutions exist to close the gap between actual returns and expected returns. From what I’ve observed, I believe the core of investors and their advisor’s failure is in not asking the question, “What is the investment for? What is the savings goal?” prior to making investment decisions.

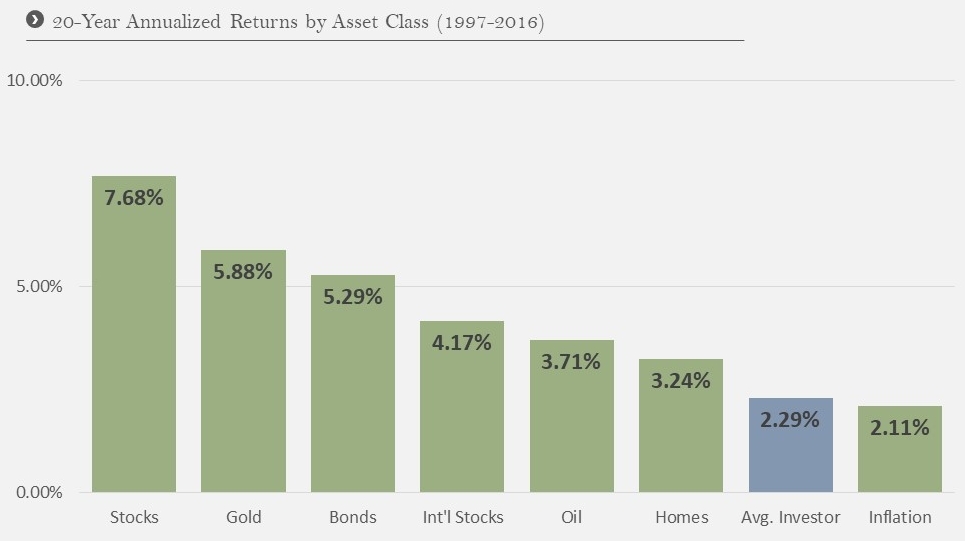

* DALBAR; Blackrock

By consequence investors have failed to keep up with the performance of even the most passive investment. As mentioned, the success or failure of the individual investor is well documented by DALBAR and Associates. In the ten years leading up to 2016, investor returns (for asset allocation funds) were 1.89% per year. This return is far less than what a bond index (e.g. Barclays Agg.) would have yielded at 4.51%. The moral of the story? Individual investor behavior is a major contributing factor to under-performance.

ASK THE QUESTION

Both advisors and individual investors must ask the question, “What is this investment for?” In other words, what are you trying to accomplish by foregoing spending right now and instead saving those dollars? Answering this question will create a goal/objective for the savings and will lead to investments that optimally align with the stated goal.

Consider for example Jane, a 25 year old investor with two different saving goals: 1) save for a house; and 2) save for retirement. It is fine if Jane thinks, “I’d like to be aggressive because I’m an aggressive person,” but that posture aligns much better with the retirement account that has 35-45 years before it is needed than it does for the house savings account with a 3-5 year saving and investing timeline. Because aligning investments with both the goal and the timeline is crucial when investing, ask the question, “Why am I saving. What is this for?”

BE DISCIPLINED

After you’ve answered the question for yourself and made the corresponding investments to align with your stated goal and timeline, it’s all about discipline. If like Jane you have a three to five year savings goal, then the objective would be a stable portfolio. But what if, during that time, Jane thought to herself, “The stock market is doing so well and my friend has made so much money investing in XYZ stock, maybe I’ll try and make a little more too.” While that is a fine thought, in the context of the goal and timeline, to act on it would be undisciplined. If the goal is to buy a house and it’s a short-term goal, the action for Jane is to maintain a stable job, budget her income, and stay disciplined to her investment plan since these will be key drivers in her ability to save for and purchase a house...not the stock her friend bought.

A lack of investment discipline may also impact the long-term investor. What if Jane made some aggressive choices for her VERY long-term retirement account? One day, the same friend who bought XYZ stock tells Jane, “I sold my stock. It was getting crushed. The market is crashing.” Jane may very easily feel that she made the wrong decision by investing “aggressively” in her retirement account and in reaction, sell. Being disciplined is about sticking to a prudent investment strategy based on your needs and timeline. For Jane, discipline may look like HOLDING these more volatile higher-earning investments not based on the short-term return but rather her long-term goals.

If the stated saving goals were aligned with the right investments, then there would be minimal volatility in the short-term house savings account. Similarly, with a longer-term goal (retirement) in place, Jane would expect to see more volatility with higher long-term returns than with the more stable investments she made for the house.

BE PATIENT

Whether you are an advisor or an individual investor, if you’ve asked the right questions and you have an investment plan to accomplish your goals, then be patient and wait for that plan to play itself out. If you’ve done the work upfront, then your probability for success will be much higher than if you failed to ask the question and go through the process.

Looking at the poor performance of the individual investor leads me to conclude two things: 1) too many investors have not asked the right question upfront to make an investment plan to meet their specific goals; and 2) those who may have started out by asking the right question have failed to stay disciplined to their objectives.

In summary,

1. Ask the questions: “What is the purpose of these funds? What is the point of saving instead of spending?”

2. Be disciplined

3. Be patient

Sources: *BlackRock; Bloomberg; Informa Investment Solutions; Dalbar. Past performance is no guarantee of future results. It is not possible to directly invest in an index. Oil is represented by the change in price of the NYMEX Light Sweet Crude Future contract. Contract size is 1,000 barrels with a contract price quoted in U.S. Dollars and Cents per barrel. Delivery dates take place every month of the year. Gold is represented by the change in the spot price of gold in USD per ounce. Homes are represented by the National Association of Realtors’ (NAR) Existing One Family Home Sales Median Price Index. Stocks are represented by the S&P 500 Index, an unmanaged index that consists of the common stocks of 500 large- capitalization companies, within various industrial sectors, most of which are listed on the New York Stock Exchange. Bonds are represented by the BBG Barclay U.S. Aggregate Bond Index, an unmanaged market-weighted index that consists of investment-grade corporate bonds (rated BBB or better), mortgages and U.S. Treasury and government agency issues with at least 1 year to maturity. International Stocks are represented by the MSCI EAFE Index, a broad-based measure of international stock performance. Inflation is represented by the Consumer Price Index. Average Investor is represented by Dalbar’s average asset allocation investor return, which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/16 to match Dalbar’s most recent analysis.