Between Fed Policy and the Presidential election, 2024 has all the makings to derail investors. While these factors introduce volatility and uncertainty, historical insights and a sound financial plan can guide those navigating the financial markets.

The year began promisingly, with the market reaching all-time highs in the first quarter of 2024. However, the start of the second quarter has highlighted the inherent unpredictability of the financial landscape. Beneath these surface-level fluctuations lies a geopolitical landscape marked by pivotal events that demand attention.

Fed policies will continue to impact market dynamics

The Federal Reserve's stance on interest rates emerges as a significant factor shaping market sentiment and performance in 2024. Speculation about potential adjustments in interest rates can significantly influence investor behavior and market dynamics. Lower interest rates can stimulate economic activity and boost equity valuations. However, uncertainties surrounding the timing and magnitude of such policy shifts add complexity to the investment landscape. At the beginning of the year, the Fed indicated it might cut rates at some point in 2024. But with inflation remaining higher than expected, it's now anticipated that there will be fewer rate cuts (if any) than initially predicted.

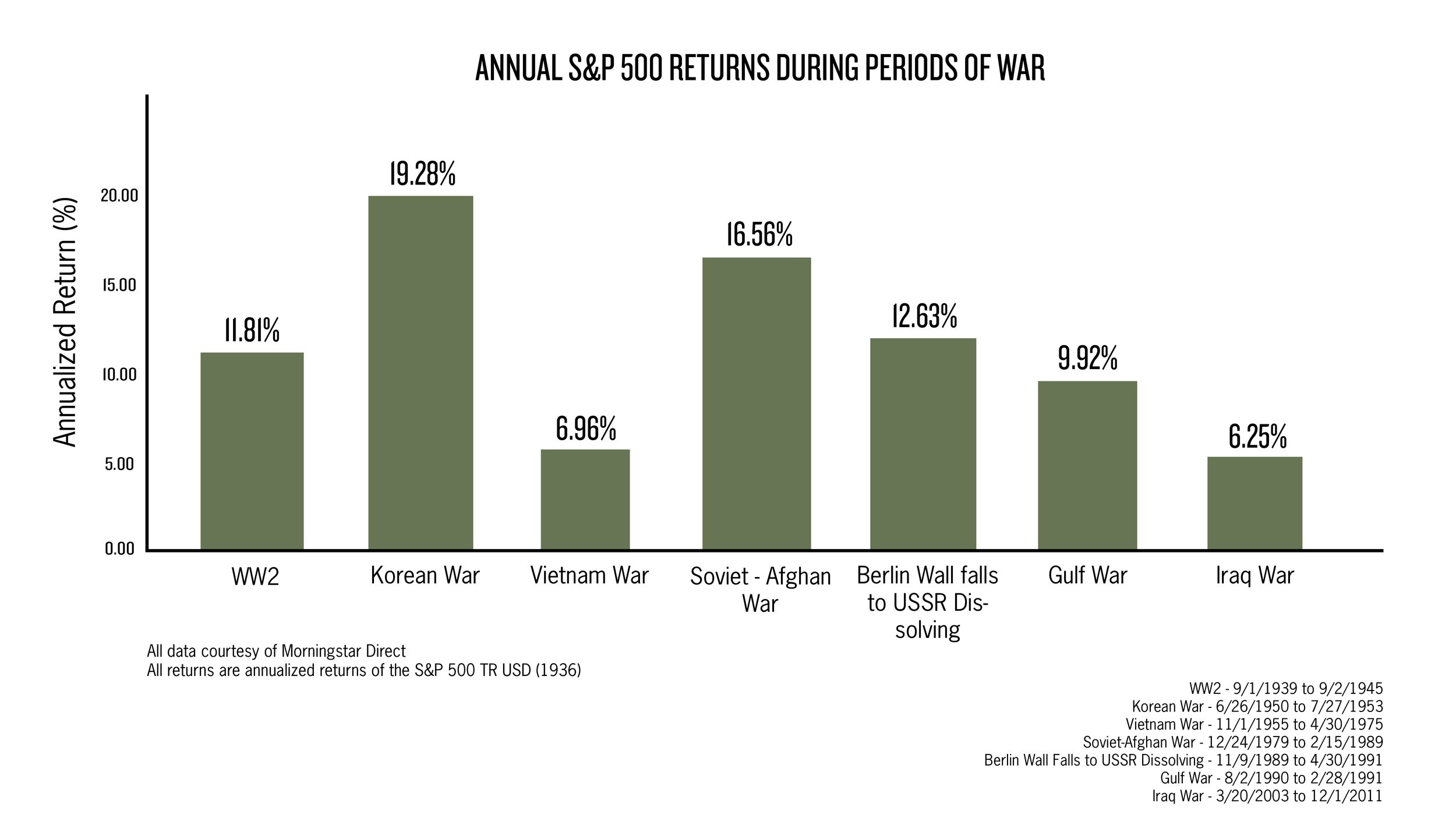

The "cost of admission": lessons from decades of market turbulence

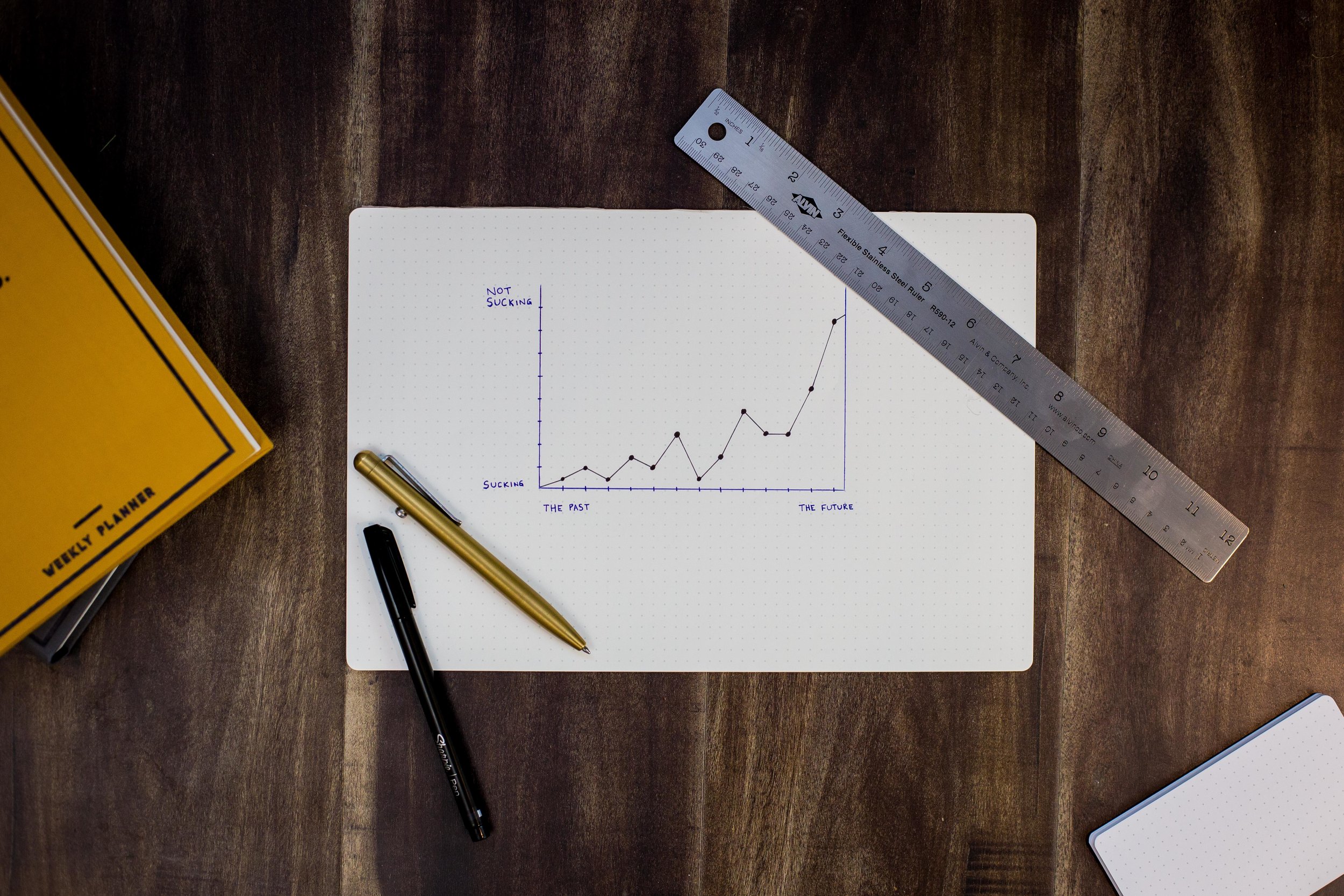

Regardless of the headlines, it's fundamental to understand that the path to stock market growth is paved with bumps in the road. The following chart from JP Morgan nicely illustrates how volatile the stock market can be over short periods of time. In the chart, grey bars represent the returns for each calendar year, while red dots show the intra-year declines.

Looking back to 1980, the S&P 500 experienced an average sell-off of 14.2%, while ending positive in 33 of the 44 years measured. This inherent market fluctuation underscores the “cost of admission” for those seeking long-term gains through stock investments.

Insights from past elections: market performance amid political uncertainty

In most years, the stock market experiences growth, and this pattern holds true for presidential election years as well. However, investors should be prepared for increased volatility due to market uncertainty. Over the past four decades, election years have witnessed heightened market volatility fueled by the ambiguity surrounding political transitions. Despite this turbulence, historical data illustrates the market's resilience.

The S&P 500 has delivered a median total return of 11% over the past ten election cycles, inclusive of the 2008 Global Financial crisis. Though slightly lower than the median return of 15% across all years since 1984, this resilience showcases the market's ability to weather political flux.

Despite the uncertainty surrounding elections, historical data indicates that remaining invested through the election has proven advantageous. Once election results are announced, returns often speed up, usually boosting equity valuations and prices post-Election Day regardless of election outcome.

Leveraging a well-crafted plan for stability

During market turbulence driven by factors such as Federal Reserve policies and elections, a well-crafted financial plan acts as a stabilizing force. As we journey through 2024, it's essential to acknowledge that fluctuations are inherent in investing. Stress-testing your financial plan against various scenarios becomes vital, providing resilience in the face of uncertainty. While headlines may evoke strong emotions, maintaining a long-term perspective grounded in a robust plan aids in navigating choppy waters.

As 2024 unfolds, investors are reminded to stay committed to their financial plan's principles. By drawing on historical insights and adhering to a clearly defined strategy, investors can confidently maneuver through market volatility, knowing that their financial plan serves as their guiding star, directing them toward their long-term objectives.

Sources

Human Investing. (2024). 2024 Q1 Economic Update: Politics and the Market. Human Investing Blog. Retrieved from https://www.humaninvesting.com/450-journal/q1-2024-economic-update

Goldman Sachs. (2024, February 1). Global Macro Research. Retrieved from [https://www.goldmansachs.com/intelligence/pages/2024-the-year-of-elections-f/report.pdf]

J.P. Morgan. (2024). Guide to the markets: March 31, 2024.