Hoping for a Nike Stock Split? Why a Stock Split should not change your investment strategy.

The recent success of Nike stock has begun to fuel questions and curiosity about a future stock split. When a company like Nike announces a stock split, does it lead to an immediate increase in value? For many investors, stock splits tend to generate enthusiasm and an expectation that the stock will experience significant growth but is that always the case? We will review what a stock split is and why companies have them. Applying it specifically to Nike, we will explore the history of Nike stock splits and how the stock performed after those splits occurred.

What is a Stock Split?

A stock split happens when a company divides its outstanding shares into multiple shares, increasing the overall number of shares. Since the underlying value of the company does not change, this results in a lower price per share. For example, if you own 50 shares of Nike and the stock price was $100/share, your total value would be $5,000. If Nike completed a 2-for-1 stock split, you would then own 100 shares with a stock price of $50/share, resulting in the same $5,000 total value.

Why Do Companies do Stock Splits? could it increase the value of the stock?

Companies have historically performed stock splits to make the stock more liquid and accessible to owners. Stock splits typically occur after a company has experienced significant growth and the higher price may become a barrier to the average investor. In the example above, you would need $100 to purchase one share of Nike before the stock split. After the 2-for-1 stock split, you would only need $50 to purchase a share of Nike.

In theory, a stock split should not change your total dollar value in the stock. However, the announcement of a stock split can create renewed interest and availability in the stock, which can result in a temporary price increase. How has the announcement of a stock split affected Nike stock historically?

History of Nike Stock Splits

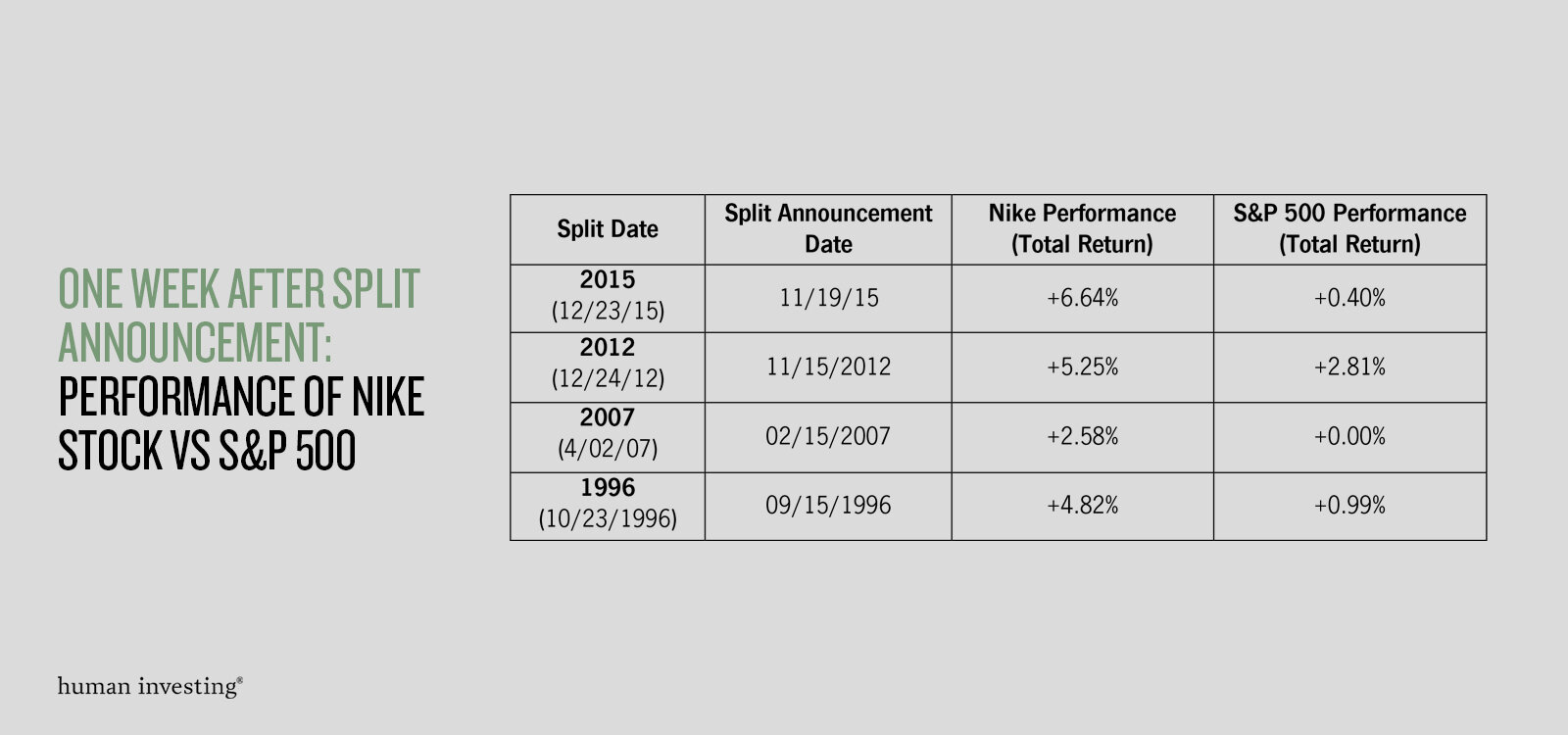

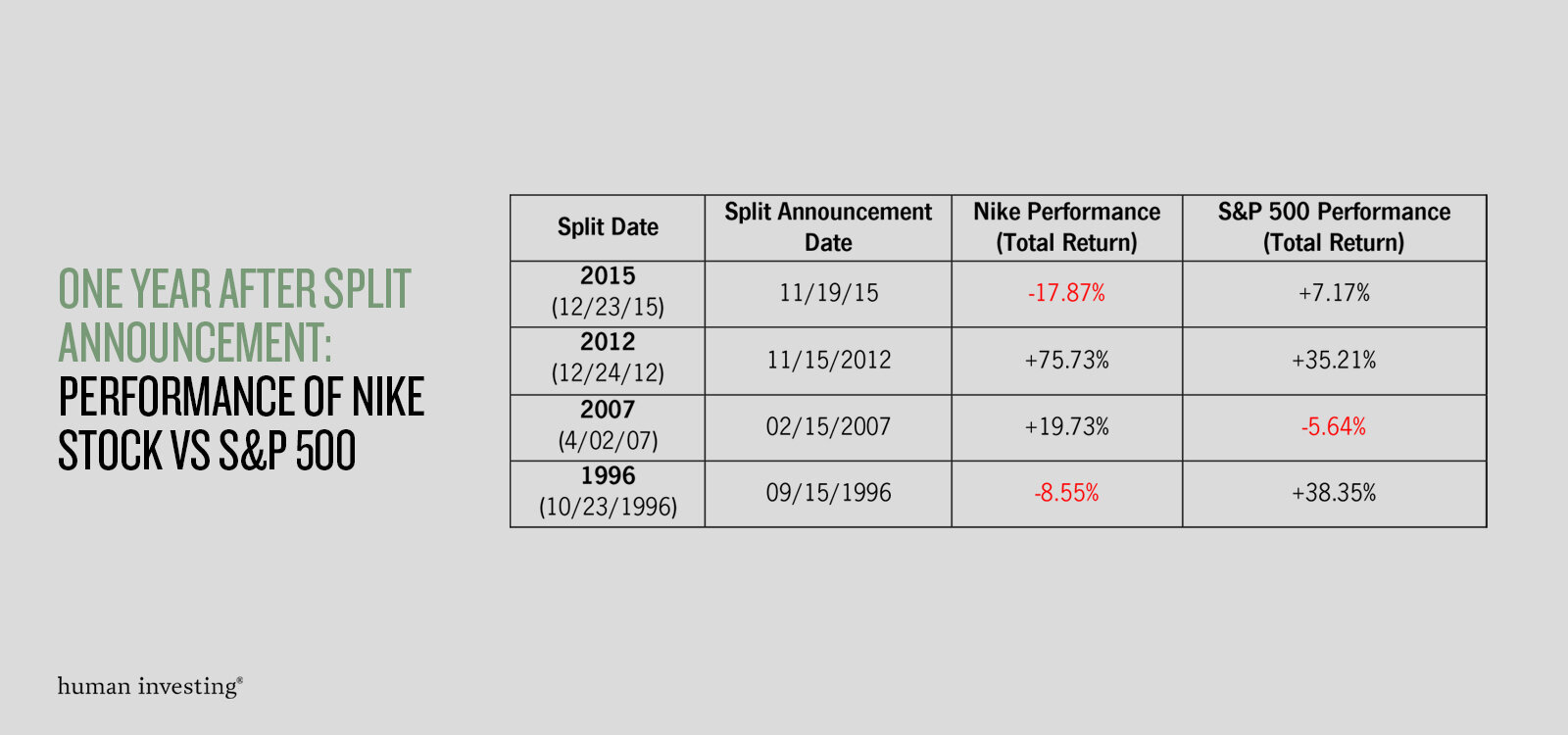

Nike has performed a 2-FOR-1 stock split seven times in its history, with the first one occurring in 1983 and the most recent one occurring in 2015. We examined the performance of Nike stock compared to the S&P 500 Index (benchmark for US Large Cap Stock Market) both 1 week and 1 year after the announcement of the last four stock splits in 1996, 2007, 2012 and 2015.

Observations of Last Four Nike Stock Splits

When observing the outcomes of the last four Nike stock splits, several points stand out.

Initial Price Bump for Nike – In all four cases, there was a solid price increase over a 1-week period after the announcement ranging from 2.5%-6.64%. This price bump was much higher compared to the S&P 500 performance over that same period. This is not surprising as a stock split announcement tends to garner interest and is considered favorable for the company.

Lack of Consistency – When you look at the 1-Year return numbers for Nike, there is much more variability in the outcomes. Although one might assume that there would be positive 1-year performance each time, the stock price was in fact negative in 2 of the 4 years.

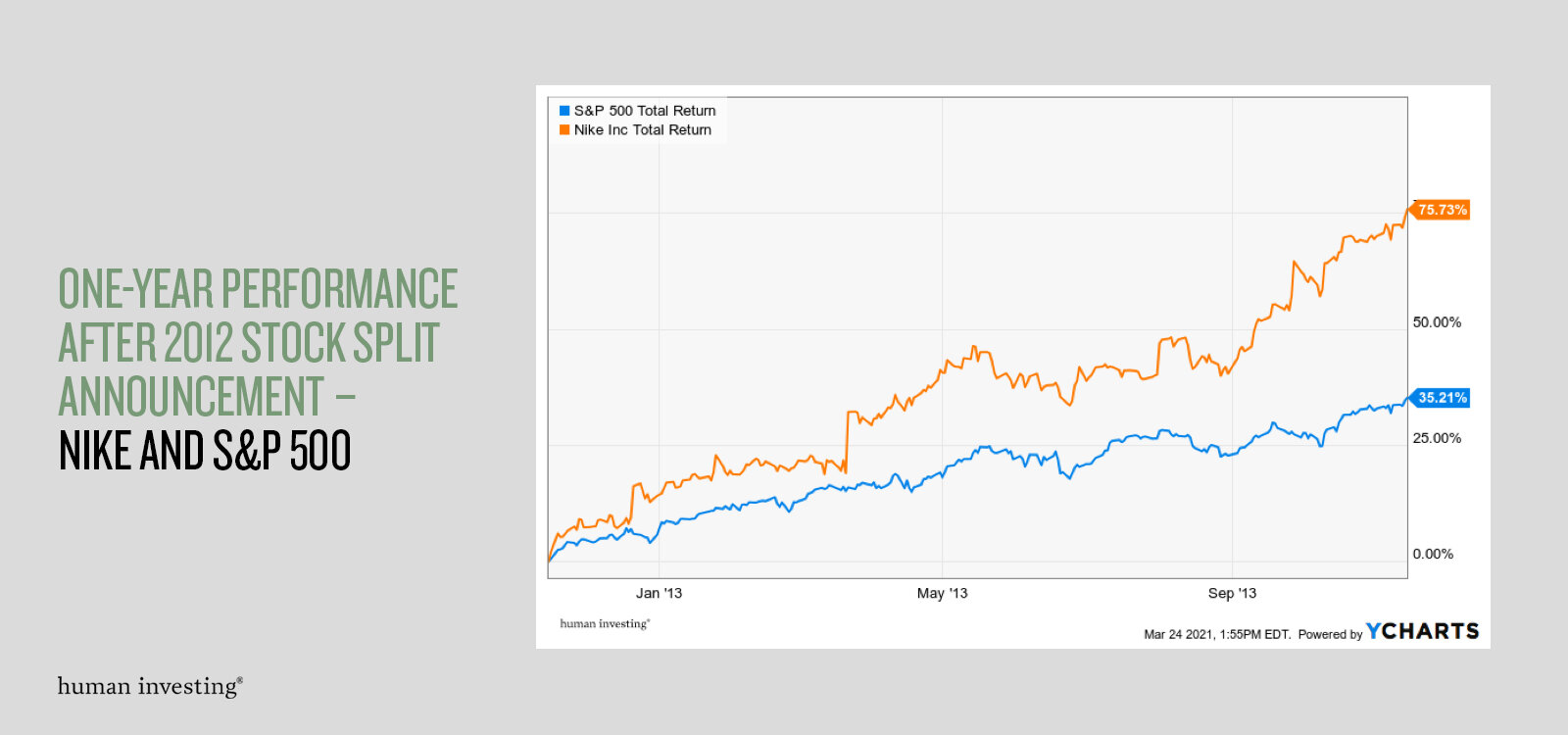

Nike and the S&P 500 were Not on the Same Page – When comparing the 1-year performance between Nike and the S&P 500, in all four instances, the variation in returns was significant and had an average return difference of 34.46%. For example, in 2012, Nike was up +75.73% versus S&P 500 at +35.21% (40.52% difference) and in 1996 Nike was down -8.55% and S&P 500 was up +35.35% (46.90% difference).

our recommendation for nike employees

During any short period of time, stock prices can move unpredictably and an event like a stock split does not necessarily result in substantial growth. Stock splits do not fundamentally create any additional value and as you can see by the last four Nike splits, the results are inconsistent. The historical performance shows that any initial price increases from the split tend to be temporary. We recommend that owners of Nike stock view their investment as long-term (10+ years), which will provide the best opportunity for success regardless of whether the stock undergoes a split or not.

If you have questions about your Nike stock and how it applies to your situation, please get in touch.

You can schedule time with me on Calendly, e-mail me at marc@humanvesting.com, or call or text me at (503) 608-2968.