With each presidential election comes a slew of new tax proposals and changes that are sometimes difficult to decode. News outlets mix proposed and enacted laws, furthering the stress that comes with determining how they will affect your taxes.

The biggest takeaway from Biden's new tax law proposals is that those who earn under $400,000 of income per year should not expect to face an increase in taxes. In fact, they are likely to see more tax credits that will help reduce their tax liability. However, those who make above $400,000 could be significantly affected by several of the proposed tax law changes.

Below is an outline of the administration’s current proposals that may become laws in the coming tax seasons based on your yearly income.

for THOSE WHO MAKE BELOW $400,000

What’s been enacted: The Dependent Care Tax Credit.

Eligible childcare expenses increased from $3,000 to $8,000 ($6,000 to $16,000 for multiple dependents) and the maximum reimbursement rate has increased from 35% to 50% for a maximum credit of $8,000. It is refundable for the 2021 tax year. If you pay for childcare services in 2021 for children 12 and under, you can claim those expenses in tax credits up to $16,000.

The Child Tax Credit has temporarily increased from $2,000 to $3,000 per child ages 6-17, and $3,600 per child aged 0-5 for the 2021 tax year. There will also be monthly payments made from July to December 2021. Half the total credit amount will be paid in advance with the monthly payments, while the other half will be claimed on the tax return that you will file next year. For example, if a single filer with an AGI of $60,000 had one 13-year-old child, they would receive $250 per month from July to December and $1,500 as a credit on their 2021 tax return.

The increase (i.e., the extra $1,000 or $1,600) is gradually phased-out for joint filers with an AGI of $150,000 or more, head-of-household filers with an AGI of $112,500 or more, and all other taxpayers with an AGI of $75,000 or more. At $440,000, couples will phase out of the tax credit entirely.

What’s been proposed: First-Time Homebuyer’s Tax Credit reinstated for up to $15,000 in refundable credits.

You may not have owned a home within the last 3 years to qualify for this credit. You must make no more than 160% of the area median income, and the home’s purchase price must be no more than 110% of the area median purchase price. You could claim this credit for primary residences purchased after Dec. 31, 2020.

for Those Who Make Above $400,000

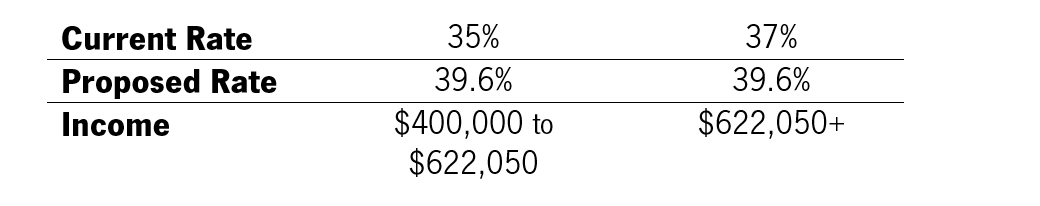

What’s been proposed: Increased income tax

Currently, the top individual income tax rate is set at 37% on earnings above $622,050 ($518,400 for those filing single). The new proposed rate is 39.6% for earnings above $400,000.

What’s been proposed: The 6.2% Social Security payroll tax on income above $400,000.

For 2021, the maximum limit on earnings for withholding of Social Security tax is $142,800. This proposed tax law would result in the 6.2% tax continuing on earned income over $400,000 in addition to the 6.2% tax on earned income up to $142,800. The income between $142,800 and $400,000 would not be subject to this tax. For example, if $450,000 is earned, $50,000 will be taxed at 6.2% resulting in $3,100 paid in SS tax on top of original cap of $8,853.60.

What’s been proposed: Long-term capital gains and qualified dividends be taxed at a rate of 43.4% on income above $1,000,000.

Long-term capital gains above $501,600 ($445,850 for those filing single) is currently taxed at 20%. In addition, they are proposing the elimination of the step-up in basis for transferred assets.

What’s been proposed: Restoration of the limitation on itemized deductions (ie. mortgage interest, charitable contributions, property taxes, etc.) for taxable income above $400,000.

This means your itemized deduction amount would be reduced by the lesser of 3% of AGI in excess of $400,000 or 80% of your itemized deductions. The state and local tax deduction limit of $10,000 could also be removed, allowing for additional deductions in state and local taxes paid above $10k. For example, a person has $750,000 of taxable income, and their itemized deductions total $75,000. 3% of their taxable income above $400,000 = $10,500, 80% of itemized deductions = 60,000. Since the 3% calculation is the lesser of the two, their itemized deduction amount of $75,000 is then reduced/lowered by $10,500, resulting in $64,500 of itemized deductions.

What’s been proposed: Pass-through deductions removed for taxpayers earning more than $400,000.

For business owners of a Sole Proprietorship, Partnership, S-Corporation, and certain trusts and estates, the Section 199A pass-through deduction for qualified businesses could be up to 20%. The maximum deduction is the lesser of 20% of an owner’s QBI, or 20% of taxable income, excluding any net capital gains. If it were to pass, this deduction would no longer be available if the taxpayers net income were above $400k.

What’s been proposed: Estate and Gift Tax exemption rates for assets may be brought back to 2009 rates.

For 2021, the unified federal gift and estate tax exemption is $11.7 million per individual. The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40% (applicable to taxable amounts above $1 million made while still alive). The estate tax exemption for Married Filing Jointly (2009): $7,000,000. For those filing Single (2009): $3,500,000. The maximum gift tax rate (2009): 45%

BUSINESS AND CORPORATE TAXATION

What’s been proposed: Increased corporate income tax from 21% to 25-28%.

While this may not directly affect your taxes, it may affect any assets you have in company stocks or potential dividends depending on how the corporation decides to deal with the increase in tax.

What’s been proposed: Minimum tax on corporations with $100 million or more in book income.

Corporations would be taxed on the greater of their regular corporate income tax rate or have a 15% minimum tax imposed on them.

It is important to remember that all proposed tax law changes would need to be reviewed and enacted by Congress in order to become official tax law. All proposed law could potentially be revised or eliminated.