Section 121 Exclusion: Is it the Right Time to Sell Your Home?

Home prices and home equity have increased substantially over the last few years, which may leave you wondering if you should sell your home. Wouldn’t selling your home be even more tempting if buying another home wasn’t so difficult?

If you are thinking about selling a home, then you are probably focused on market timing, payments, moving and lifestyle changes. One thing you may have overlooked are the tax considerations of selling a home.

You may be thinking, “wait, isn’t the sale of my main home tax free?”

It depends.

Primary homes are considered capital assets, like investments such as stocks and bonds. Capital assets are normally subject to capital gains taxes when they are sold. However, primary homes may qualify for a favorable capital gains treatment called the Section 121 exclusion.

For most homeowners, the Section 121 exclusion is one of the greatest benefits of the current tax code. Are you aware of how this exclusion works and how to ensure you qualify?

Start With your Capital Gains

Before making the decision to sell your home, start by calculating your capital gains. A gain on the sale of a primary residence is calculated as such:

Sale price - (Purchase price + Improvements) = Capital Gain

Breaking Down the Section 121 Capital Gain Exclusion and its Qualifications

The 2-out-of-5 year capital gain exemption is crucial for homeowners to understand.

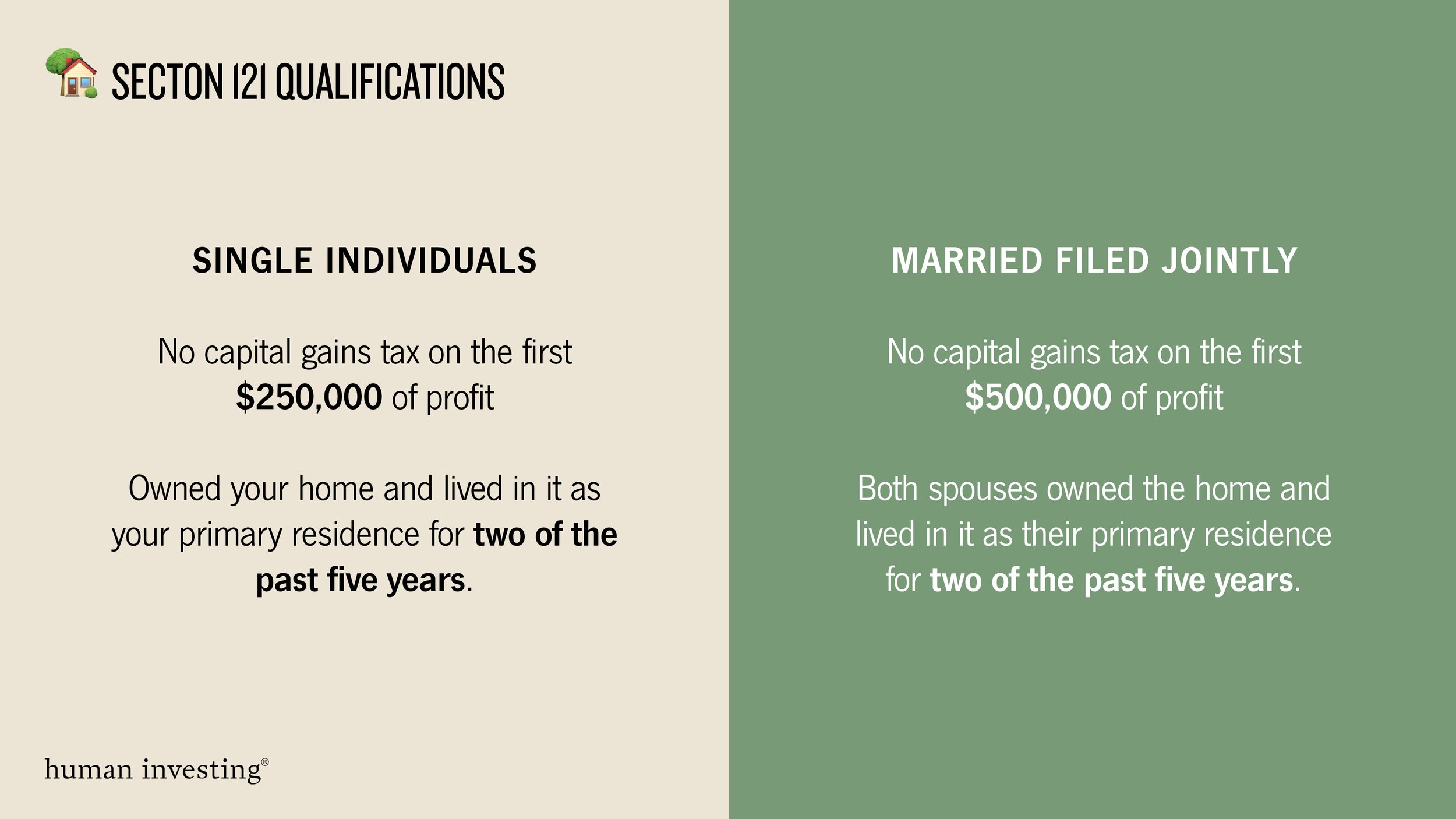

The IRS allows homeowners to exclude part of your home sale from capital gain taxes if you’ve owned your home and lived in it as your primary residence for two of the past five years. The 24 months do not have to be consecutive months, but rather a total of 24 months within a 5-year period. If you qualify for the 2-out-of-5 year rule, then you have the following gain exclusion when selling your home:

The profit mentioned above does not include outstanding mortgage. If there is an outstanding mortgage on the home, this will not impact the Section 121 capital gain exclusion amount. Please read example #1 below to see how mortgages do not impact the overall capital gain.

Partial Gain Exclusions and Benefit Timing

Even if you haven’t lived in your home two out of five of the years prior to selling the home, there may be a way to qualify for a partial gain exclusion. For example, you could be eligible for a partial gain exclusion if you had to move due to work-related reasons, health-related reasons, or for unforeseen circumstances such as divorce or giving birth to two or more children from the same pregnancy.

Homeowners can benefit from this Section 121 capital gain exclusion once every two years. For example, if you have two homes and lived in both for at least two of the past 5 years, both homes are not eligible for the capital gains exclusion at the same time.

Four Examples of the Section 121 exclusion

EXAMPLE #1: SINGLE-FILING TAXPAYER

Jordan purchased a home in 2016 for $350,000 and sold it in 2022 for $560,000.

Jordan lived in her home for these 6 consecutive years. When she listed her home for sale, Jordan still had an outstanding mortgage of $75,000 on her home. As mentioned above, mortgages are not part of calculating the total Section 121 gain exclusion. Jordan has a total gain of $210,000 ($560,000 sale price - $350,000 purchase price). For a single taxpayer, none of this gain is subject to taxes because it is less than the exclusion amount of $250,000. Time for Jordan to enjoy her celebration of choice.

EXAMPLE #2: COUPLE FILING TAXES JOINTLY

Marta and Paul purchased a home in 1999 for $350,000 and sold it in 2022 for $1,000,000.

Marta and Paul raised their children in this home for the past 23 years, except for in 2006 when they rented their home for a sabbatical year. The total gain on the sale of the home is $650,000. They will only pay capital gains on $150,000, since $500,000 is subject to the Section 121 gain exclusion.

EXAMPLE #3: VACATION HOME TURNED TO A PRIMARY RESIDENCE

Samuel and Taylor bought a vacation home on the coast in 2010 for $300,000. They used the home as a vacation home for the first 10 years, and then converted it to their primary residence in 2020. Samuel and Taylor would like to sell their home at some point in 2022 for $500,000.

The first 10 years of ownership are considered non-qualified use. Non-qualified use is any period after 2008 when the home was not used as a primary residence. Examples of non-qualified use are vacation homes, rental properties, investment properties, or homes used in a trade of business. Homeowners cannot take the full tax-free exclusion under Section 121 if a property was held and used for non-qualified use prior to it being held as a primary residence (qualified use).

In this example, 2/12ths of the total $200,000 of capital gain can be excluded from taxable income ($33,333) as qualified under Section 121 and 10/12ths ($167,666) of the total capital gain must be included in taxable income as non-qualified use under Section 121.

*There are some exceptions to non-qualified use. They are listed under the Business or Rental Use of Home section.

EXAMPLE #4: HOMEOWNERS TURNED TO LANDLORDS

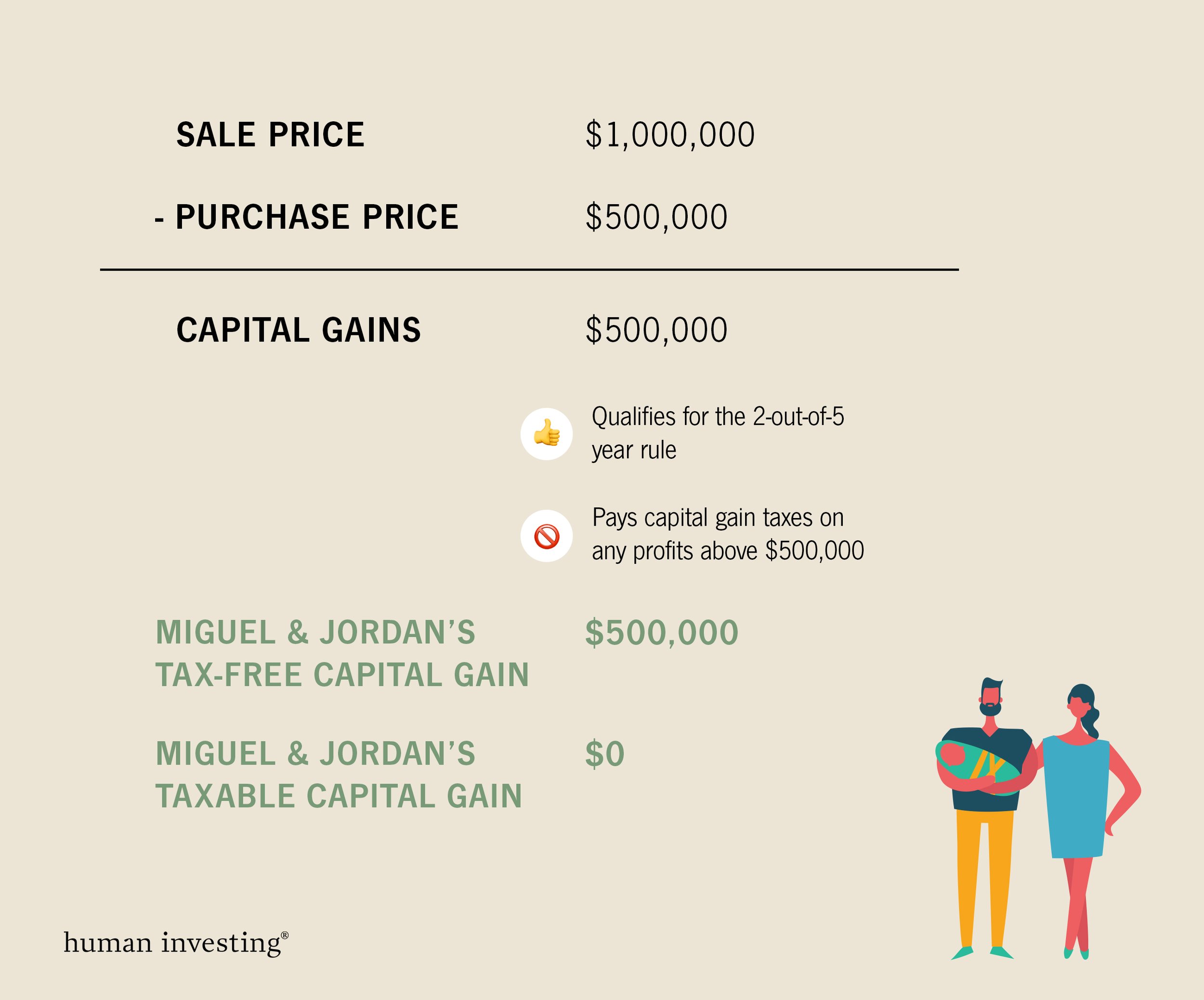

Miguel and Jasmine purchased their primary home in 2012 for $500,000. They moved out of the home and started renting it in 2020. They sold their home for $1,000,000 in 2022.

Since they wanted to utilize the Section 121 gain exclusion, they had to sell the home in 2022. To articulate the importance this sale timing, here is a detailed timeline:

2018 – home used as their primary home

2019 – home used as their primary home

2020 – home used as a rental home

2021 – home used as a rental home

2022 – home used as a rental home for most of the year and sold for $1,000,000 on May 15, 2022

Since they sold this home during 2022, which meets the 2-out-of-5 year exclusion rule, they can utilize the full tax-free exclusion on the $500,000 gain. ** They may owe tax on the depreciation recapture.

However, if they waited to sell their home until 2023, Miguel and Jasmine would pay capital gains tax on the entire $500,000 gain since they wouldn’t have qualified for the 2-out-of-5 year exclusion rule in this case. As this example illustrates, being mindful of your timeline for selling a home is critical.

Tax Planning for your Home(s) IS CRUCIAL IN MAXIMIZING WHAT YOU CAN POCKET

As you may have gathered from this blog post, buying and selling homes may involve complicated tax planning. Given the prolonged seller’s market, our team has worked on several tax planning scenarios and strategies for different clients. If you would like to speak to us about your own unique scenario, please reach out to us at hi@humaninvesting.com or 503-905-3100.