Taking a distribution from a tax-qualified retirement plan, like a 401(k) before age 59.5, is generally subject to a 10% penalty for early withdrawal. The exceptions to paying this 10% penalty are:

Rule of 55

Are you familiar with how the Rule of 55 works? If you want to retire early, this blog post is significant for you.

What is the Rule of 55?

The Rule of 55 is an IRS provision that allows employees who leave their job on or after age 55 to take penalty-free distributions from their retirement accounts. It’s a life hack! Typically, individuals would face a 10% early-withdrawal penalty if they access their retirement account before age 59.5. The 10% penalty and account accessibility are two of the reasons why people plan to work until at least age 59.5.

If you are someone who is thinking about retiring early, the following Rule of 55 requirements are necessary:

You leave your job (voluntarily or involuntarily) in or after the year you turn 55 years old.

Your plan must allow for withdrawals before age 59.5.

Your dollars must be kept in your employer’s retirement plan. If you roll them over to an IRA, you lose the Rule of 55 protection.

You will likely want your plan to allow partial distributions when you are terminated.

Access to your retirement account at age 55 is available for all employees with an employer-sponsored retirement account. However, if you are considering retiring after age 55 and using funds from this retirement account, you must check whether your plan allows partial distributions. This feature is an opt-in feature for employers to select. We recommend that you work closely with your recordkeeper to ensure you can take advantage of the Rule of 55 in a way that benefits you.

3 Examples of the Rule of 55

Look at a few examples of employees with partial distributions compared to employees without partial distributions allowed in their plan.

Example 1: Partial Distributions Allowed

Danielle can take any amount from her PDX 401(k) account. For example, in October 2022, she can request $30,000. She doesn’t have to take anything out in 2023. She could take another $65,000 out in January 2024.

EXAMPLE 2: Partial Distributions Disallowed

Martin’s employer-sponsored retirement plan does not permit partial distributions. If he wants to access his retirement account at age 57 without incurring a 10% early-withdrawal penalty, he would have to withdraw the entire $450,000. This would result in reporting $450,000 of taxable income for the year of his distribution. Given the tax bracket optimization strategies that exist during retirement years, this may not be Martin’s best solution for accessing dollars before age 59.5.

A couple of alternative solutions for Martin are:

Ideally, Martin would have a cash-flow plan to support his expenses until he reaches age 59.5.

Initiate a direct rollover of his $450,000 retirement account into a IRA account. Then take distributions as needed but expect to pay a 10% penalty on these dollars. Before paying a 10% penalty on an early-distribution from a IRA, we would recommend that Martin review other cashflow options he may have.

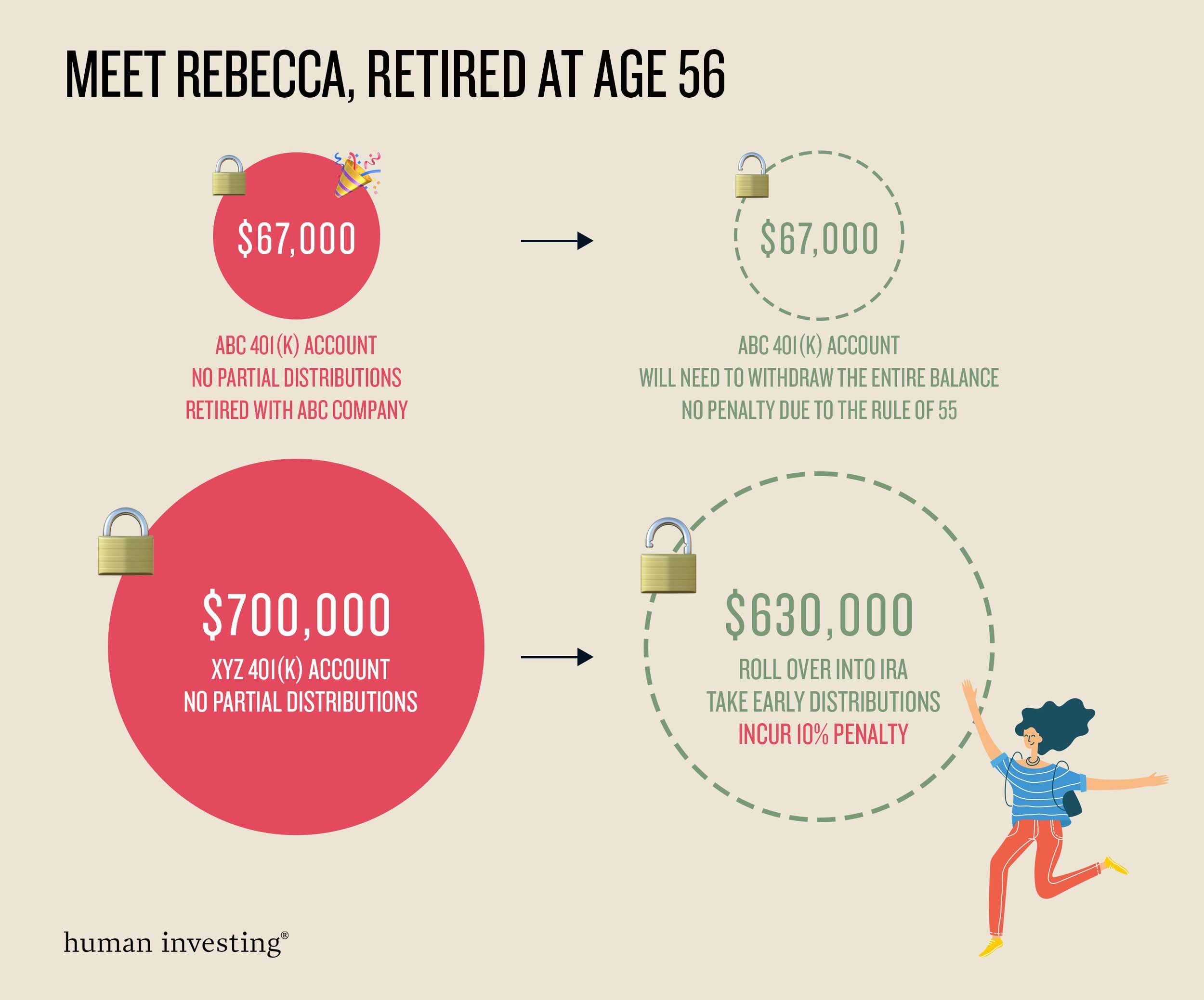

Example 3: Partial Distributions Disallowed

Rebecca, age 56, has $67,000 saved in her most recent 401(k) account with ABC Company. She also has $700,000 saved in her previous 401(k) account with XYZ Company. Neither of these retirement plans allow for partial distributions.

Rebecca retired at age 56 from ABC Company, so she can take the entire $67,000 balance out in one lump sum distribution. She will not owe a 10% penalty on these dollars due to the Rule of 55.

If she were to access any of her $700,000 saved in her previous 401(k) account with XYZ Company before age 59.5, then she would incur a 10% penalty. Not to mention the $700,000 is sitting in a plan that disallows partial distributions so that would be significant taxable income to report in the same tax year. Similar to the example above, Rebecca may consider initiating a direct rollover of her $700,000 into a IRA account for more flexible distribution choices.

What About Other 401(k) Accounts from Previous Jobs?

To qualify for the Rule of 55, you must be terminated as an employee on or after age 55. Therefore, if you have multiple retirement accounts, the only ones that will qualify for a penalty-free distribution between ages 55 and 59.5 are accounts with your termination date reflecting that age range.

One consideration is to roll over a previous retirement account into your current account before you retire. We recommend speaking with your recordkeeper to confirm that your retirement plan features are designed so rollover sources can be accessible by partial distributions.

For example, if Danielle from above had another 401(k) account, she could have rolled that into her PDX 401(k) account before retiring. All the dollars in the account would be eligible for Rule of 55 distributions.

What if I Decide to go Back to Work but have Taken Distributions Already?

Going back to work after you have taken a Rule of 55 distribution should not result in a 10% penalty. If you go back to work for the same company, then you may lose the ability to access funds as an active employee. However, your distributions will not be impacted if you go back to work at another organization.

How are Rule of 55 Distributions Tracked for Tax Reasons?

Custodians and recordkeepers are responsible for providing a Form 1099-R. This tax form reports any distributions from a retirement account. If you take a distribution under the Rule of 55, you would expect to see code 2 in box 7 of your 1099-R form. Code 2 specifies the following:

2 - Early distribution, exception applies (under age 59.5)

If your 1099-R form includes Code 2 in box 7, you will not owe a 10% penalty. Before you initiate a withdrawal between ages 55-59.5, we recommend confirming your record keeper will issue the 1099 in this format.

What Other Resources do you Have?

Retirement is a transition that only happens once in life. You probably haven’t retired before, and you likely won’t retire again. Retirement transitions involve several financial planning considerations and we wanted to conclude this article with additional resources that may be helpful to you:

The 3 Questions to Ask to Build a Solid Retirement Income Plan

Why an IRA Makes More Sense in Retirement than your 401(k)

While the articles are supplemental information, we believe the best way to prepare for your upcoming retirement is to collaborate with our team at Human Investing. Please use this scheduling link to meet with our team to review your unique financial landscape before you start planning your retirement celebration(s): Schedule here.