Markets have been moving fast lately — in both directions

Down 10% in two days. Up almost the same the next. Three trading days: A full year’s worth of returns gone, and then mostly back again.

Looking at the S&P 500 last week feels disorienting. And in a way, that’s the point.

This kind of movement makes people wonder if the system is broken. But this is exactly how markets work. They are brutally efficient at processing new information, whether it’s political, economic, or emotional.

Markets don’t wait for clarity. They move quickly on possibility, repricing risk in real time, regardless of how ready you feel. And when things are uncertain—when leadership seems unpredictable, policy is in flux, or the narrative changes overnight—the swings can be dramatic.

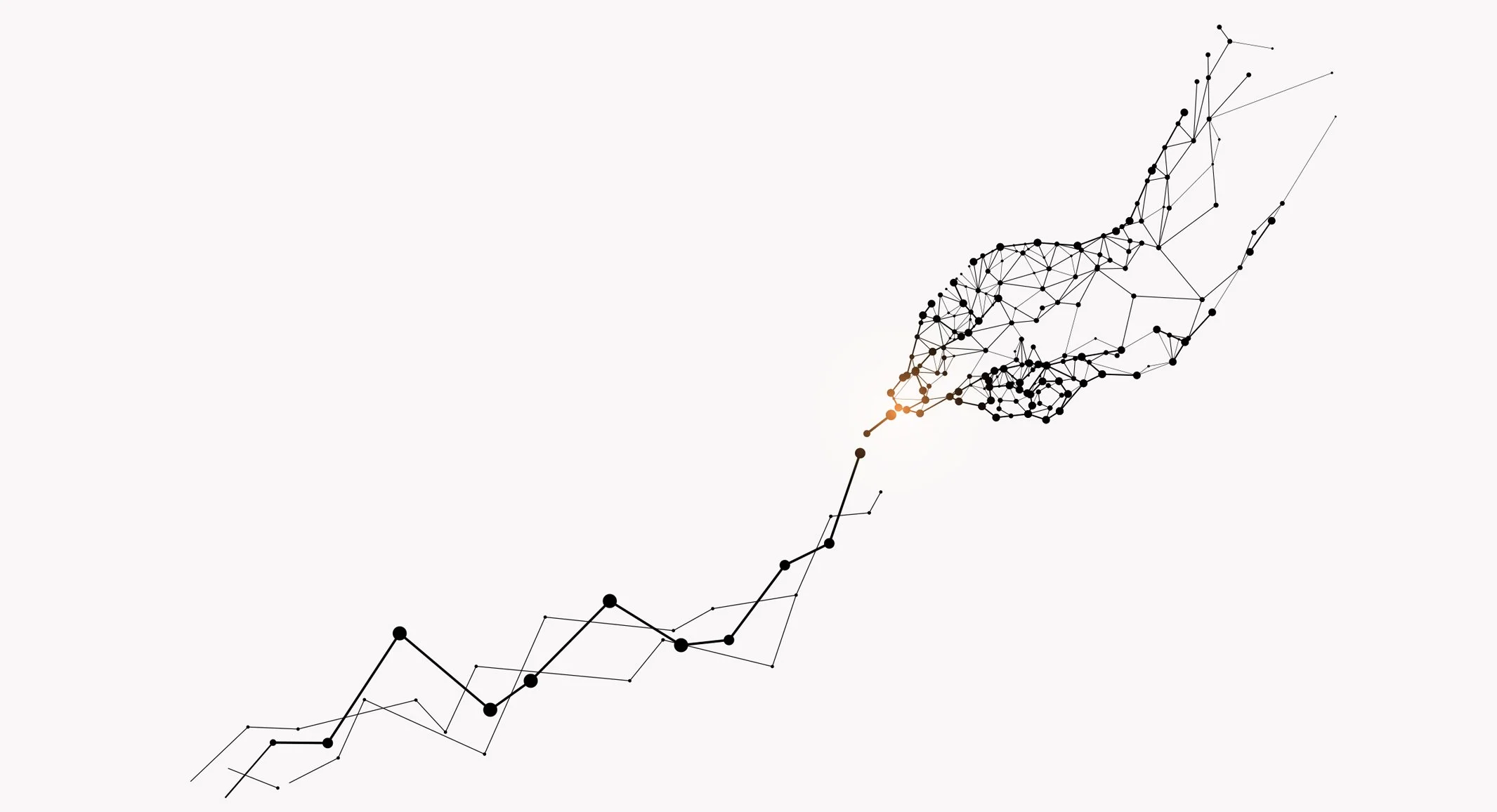

Fast drops, slow climbs — that’s the deal

Volatility is the price of admission for long-term growth. There’s a reason people say, “Markets take the stairs up and the elevator down.” Even looking at the last few years, gains usually build gradually, while losses often arrive quickly and unexpectedly.

Yet, over the decades, the odds have been in your favor. On average, the S&P 500 has risen in 52% of trading days, 73% of calendar years, and 94% of decades. (Source: Capital Group)

Three days of outliers over the last 25 years

The sharp losses of April 3rd and 4th, followed by the rebound on April 9th, are outliers in magnitude but not in pattern. The biggest gains and losses tend to cluster together, and they often show up when they’re least expected. Selling after a big drop means missing the potential surge that follows. Buying after a big rally means forgetting what preceded it.

This isn’t a timing game. It’s a discipline game

Discipline doesn’t mean knowing what happens next. It means staying in the game when it feels like the rules are changing. It means resisting the urge to flinch when the noise gets loud.

The headlines will keep coming, and volatility will return. But the most reliable part of markets is that they change. The market may take the stairs up and the elevator down — but over time, it remains one of the most reliable places to grow long-term wealth.

Hold fast to your financial plan. Stay invested.

Disclosures: These market returns are based on past performance of an index for illustrative purposes only. Past performance does not guarantee future results. All investing involves risk, including the loss of principal. Index performance is provided for illustrative purposes only and does not reflect the performance of an actual investment. Investors cannot invest directly in an index.

The information provided in this communication is for informational and educational purposes only and should not be construed as investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change at any time, and there is no assurance that any investment strategy will be successful.

Diversification does not guarantee a profit or protect against a loss in declining markets. Asset allocation and portfolio strategies do not ensure a profit or guarantee against loss.

The opinions expressed in this communication reflect our best judgment at the time of publication and are subject to change without notice. Any references to specific securities, asset classes, or financial strategies are for illustrative purposes only and should not be considered individualized recommendations.

Human Investing is a SEC Registered Investment Adviser. Registration as an investment adviser does not imply any level of skill or training and does not constitute an endorsement by the Comission. Please consult with your financial advisor to determine the appropriateness of any investment strategy based on your individual circumstances.