What You Need to Know About Sequence Risk

Image credit: Amol Tyagi

Over the last nine months since my daughter was born, I have learned to hear and translate her grunts, squeals, cries, and even noises that sound very similar to what a pterodactyl probably sounded like. The other night I woke to a cry that was not familiar. In her sleep she had stuck her foot through the slats in the side of the crib, but when she turned to pull her foot out, she could not; her foot was stuck. Putting her foot in the space between slats was easy, pulling it out…well, that was a different story.

This experience can be similar to that of an investor who has saved well for retirement but may have difficulties withdrawing dollars due to Sequence Risk. Sequence Risk, also known as sequence of return risk, is the risk assumed by an investor taking withdrawals from an investment account when receiving lower or negative investment returns. Specifically, this becomes serious early on in someone’s withdrawal timeline, as the investor/retiree ends up withdrawing a larger portion of their total portfolio than planned. Knowing what Sequence Risk is and how to plan for it is instrumental to a successful long-term financial plan. To illustrate Sequence Risk and its impact, let’s first look at the 20-year experience of two investors who are not taking withdrawals (Scenario 1) compared to the experience of the same two investors who are withdrawing from their accounts during that same 20-year period (Scenario 2).

A Scenario of Two Markets

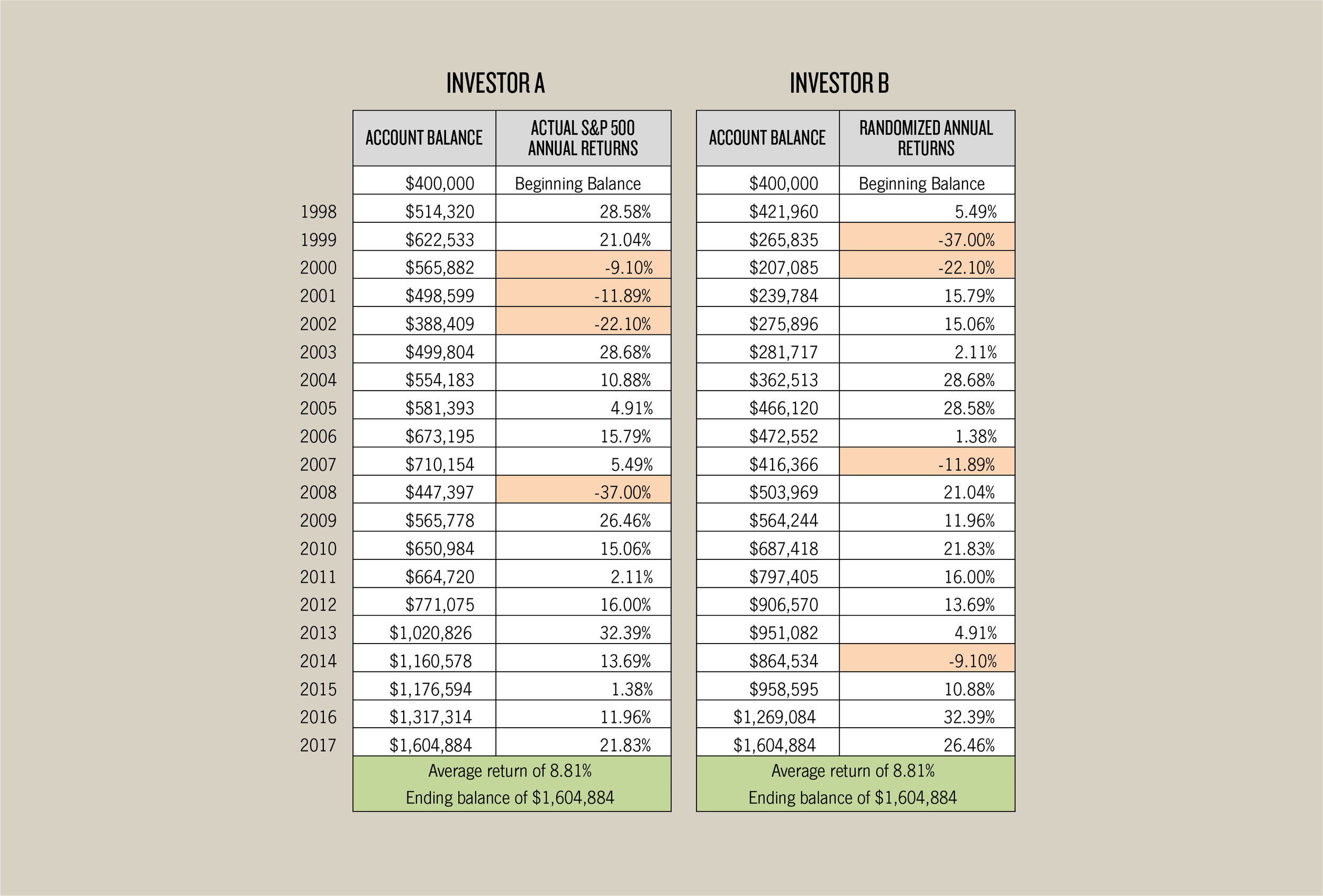

Investor A deposits a lump sum of $400,000 in the S&P 500 (500 biggest companies in the US) on January 1, 1998. Investor A does not touch her investments for 20 years and now her balance is over $1,600,000, despite both the Dotcom Crash and the 2008 Financial Crisis. A great reward for the disciplined long-term investor.

With Investor B we see a similar scenario. She deposits a lump sum of $400,000 in the S&P 500 and doesn’t touch it for 20 years. Except this time the annual returns of the S&P 500, while staying the same, are randomized in their order and weighted for an early market downturn of two consecutive years of negative returns (-37% and -22.1%). After 20 years Investor B arrives at the same balance of over $1,600,000.

Scenario 1:

For the long-term investor, the sequence of returns does not seem to influence the investor’s portfolio if he or she is not withdrawing from their investments. Both Investor A and Investor B, while having very different market experiences, arrive at the same place. A great case for the long-term investor to not balk at market volatility.

The Sequence Risk for a Retiree

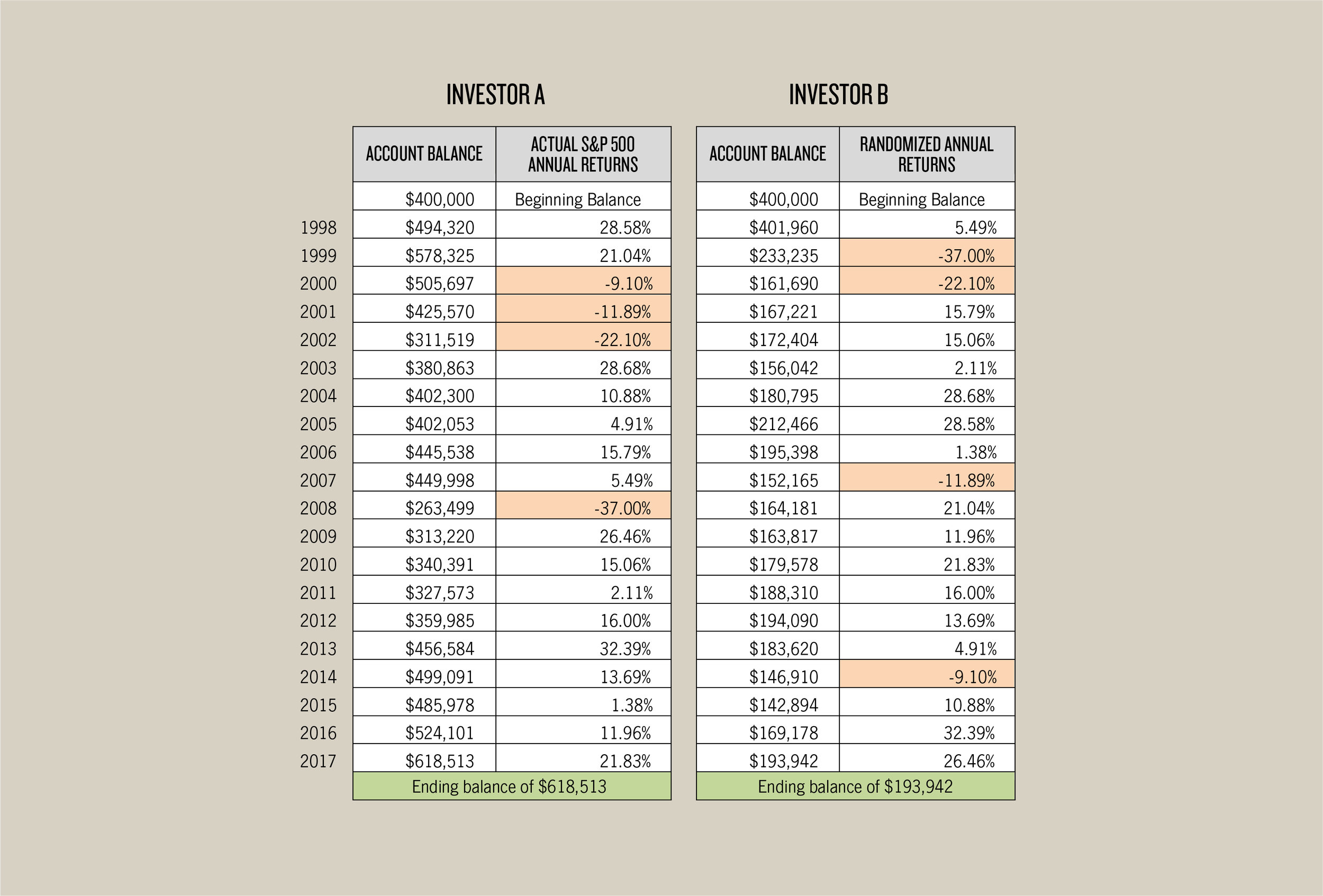

Where the order of returns does impact the investor (i.e., a retiree) is when they begin withdrawing from their investments in a down market. To see the impact Sequence Risk has on an investor, we will look at the same investment returns experienced by Investor A and Investor B. In this scenario the difference is each investor will begin taking annual withdrawals of $20,000 (5% of beginning balance) at the end of each year.

With Investor A, we see after the market experience of the S&P 500 from 1998 to 2017, she would expect to have $618k after 20 years of retirement.

As for Investor B, when the market experience begins with a downturn for the investor, the retiree’s balance would be significantly less, only $193k. A difference in the order of returns can mean a difference of almost $425k, or a 1/3 of the portfolio size, after 20 years.

Scenario 2:

Why does it matter?

Two retirees with identical wealth can have entirely different financial outcomes, depending on the state of the market when they start retirement and begin taking withdrawals, even if the long-term market averages are the same.

What do you need to do?

While you cannot control what the sequence of future returns is, there are things you can do to impact the success of your financial plan. If you are a long-term investor, make sure you have a plan, revisit the plan annually, and stay disciplined. If you are already in or are entering retirement, it is important for you and your advisor to plan accordingly:

Assess your risk. Appropriately assess your risk as you are entering retirement years. Assuming more risk than necessary paired with a down market can make you greatly susceptible to Sequence Risk.

Lower retirement expenses. Pay off any debt (including mortgage payments) before entering into retirement. Having fewer expenses in retirement provides flexibility for when the markets get rocky and withdrawing less is prudent (based on what was just laid out about Sequence Risk).

Have a short-term strategy be a part of your long-term financial plan. Hold assets that allow for flexible spending without having to veer from your long-term strategy. Holding cash or fixed income investments can provide short-term income sources, helping you avoid withdrawing a large portion of your total portfolio in a down market.

Continue working. If entering into a market experiencing low or negative returns, keep your job. What no retiree wants to hear after a long career of hard work! However, continuing to save and to delay retirement withdrawals by even a few years has the potential to yield long-term exponential growth.

While my daughter had no issue putting her foot in the space between slats, the issue was pulling her foot out. Dad was able to save the day. Realizing the most efficient angle, I was able to help her pull her foot out. With investors, sometimes it takes someone to come alongside and help strategize the most efficient strategy to withdraw dollars, no matter what is going on in the market. If you are planning on retiring soon and want help building a tailored financial plan and assessing the risk on your retirement accounts, let us know. Human Investing is here to help.

*Scenarios are used for illustration purposes only. Past performance is not an indicator of future outcomes.