Why Dollar-Cost Averaging is a Great Investment Strategy

A recent theme in our client conversations has been around the timing of investing. On a regular basis we hear the question, “when is the right time to invest?” especially when times are uncertain. It’s a great question, one that is worth considering, but before answering this question let me state: We at Human Investing are long-term investors. Don’t mistake that for “buy and hold,” but rather “buy and assess.” Additionally, we believe financial planning is the key to investment success. While planning does not guarantee success, it does improve the odds of a successful outcome. In our advisory practice, the financial plan informs the investment decision.

Once the plan is in place and we’ve made the decision to invest, the timing of investing may not always mean we push a button to invest one hundred percent of someone’s capital in that moment. What it does mean is that we have a thoughtful discussion on the different strategies we might utilize to put the money to work, choosing the right option based on the client’s plan and their input.

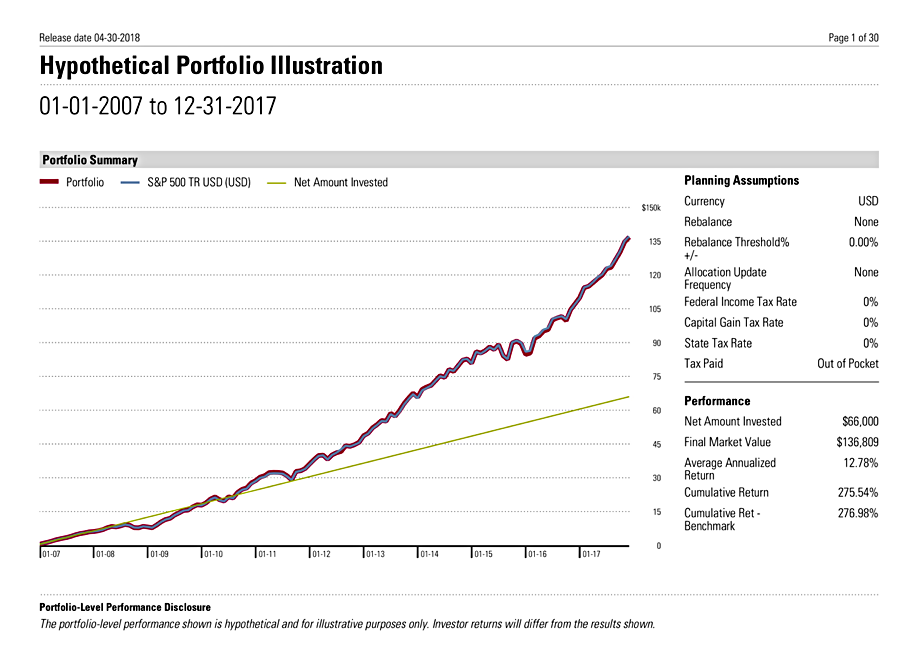

Let’s walk through an example. The chart below is a hypothetical client who invests $500 per month ($6k/year) over an eleven year period starting January 2007 and ending December 2017. For this exercise we simulated investing the $500/month into a simple total stock market index exchange-traded fund with the symbol ITOT. The total invested capital in 2007 was $66,000 with net proceeds of $136,809 on the last day of 2017. Pretty incredible results considering the eleven year time frame included small gain and loss years of 2007, 2011, and 2015 and a large loss of 39.42% in 2008.

This is a great example of a strategy called dollar-cost averaging. Dollar-cost averaging is an investment strategy with the goal of reducing the impact of volatility on large purchases by adding small amounts of the intended purchase into the market over a specified period of time. Technically speaking, taking a lump sum and immediately investing the funds for an extended period of time is the best option. The challenge with the lump sum method is that many investors struggle to invest 100% of their money right away due to factors like willpower and emotion. With the dollar-cost averaging approach the investor puts his money to work bit-by-bit, which for many, feels good emotionally and prevents money ear-marked for investing from staying in cash too long. For these reasons and others, the methodical dollar-cost averaging approach has become the most successful way to invest capital for the long-run.

My intent is not to vilify a cash investment as bad. For many investors cash has a place and a purpose within their overall portfolio. I’m looking to highlight an effective approach/strategy for when a client’s financial plan requires a greater return than 1%.

If you’ve asked the question, “What is this money for?” and the timeline is long-term, consider the total sum you are looking to invest, divide that sum into a reasonable time period and make a commitment to dollar-cost average those funds into the market. In doing so you won’t find that you’ve kept the funds in cash for any longer than is necessary, and you will be well on your way to your stated long-term savings and investment goal.