At Human Investing our advisors talk a lot about retirement, but more and more so, health care is becoming a larger component of how we need to plan. Below are 3 ways you can prepare for the medical needs that come with retirement years as well as an illustration from my life of what happens when you take your health for granted. This past weekend I competed with a team of coworkers and friends in the Wild Canyon Games, a weekend long multi event adventure race that takes pride in pushing its competitors to “find their limits.”

My most anticipated event was geocaching. My teammate/coworker Andrew Nelson and I spent 4 hours running 17 miles in the rugged terrain near Antelope, OR hunting for and finding hidden objects (caches) by means of GPS. Leading up to this event we knew preparation was key so we diligently used google maps and GPS software to plot our course to find the most valuable caches. We printed off maps and purchased the necessary gear to compete in this event.

GPS

The Right Equipment

A Winning Strategy

Slight Insanity

A Below Average Sense of Direction

We were as prepared as a team could be, or so I thought… Now fast-forward to the event. It was mile 13 of 17 total miles and the end was in sight. Andrew and I were running to the finish line, and this is when things started going south for me. My vision blurred, my hamstrings balled up, my mental determination faded and each step was more difficult than the previous one. I didn’t “find my limit,” my limit found me and hit me square in the jaw. I wanted to crawl into a hole and hide. My body was shutting down. In all my preparation, I didn’t take into account my physical health. I didn’t train enough, eat enough or drink enough I didn’t prepare accordingly.

When running the race of life, many make a similar mistake. We become so busy thinking about everything else that we forget to take care of ourselves. Our busyness may hinder our health, especially as we look to the future and see the reality of our situation. The reality: health care in the United States is becoming more expensive: • Premiums, deductibles and other out-of-pocket expenses could cost a 65-year-old couple retiring today a jaw-dropping $220,000 – and that’s in addition to Medicare premiums.” (AARP.org)

• “The cost of health care is rising faster than inflation” (Forbes)

• According to the World Bank the average life expectancy in the US is 79 years, meaning retirement is lasting longer than ever before.

As we look down the trail towards retirement we can expect the same trend of rising health care needs and health care costs. The more you know and plan for you and your family’s health care, the better off you will be in the long run. Here are 3 thoughts to help you make sure your golden years of retirement stay golden:

1. Take advantage of your HSA- Many companies today are going the way of a High Deductible Health Plan (HDHP), frequently paired up with a Health Savings Account (HSA). An HSA has a triple tax advantage when used to save for inevitable health care costs:

1) Contributions (money put into the account) are pretax. 2) Through interest, dividends or capital gains your account can grow tax free. 3) Any withdrawals for qualified medical expenses are tax free.

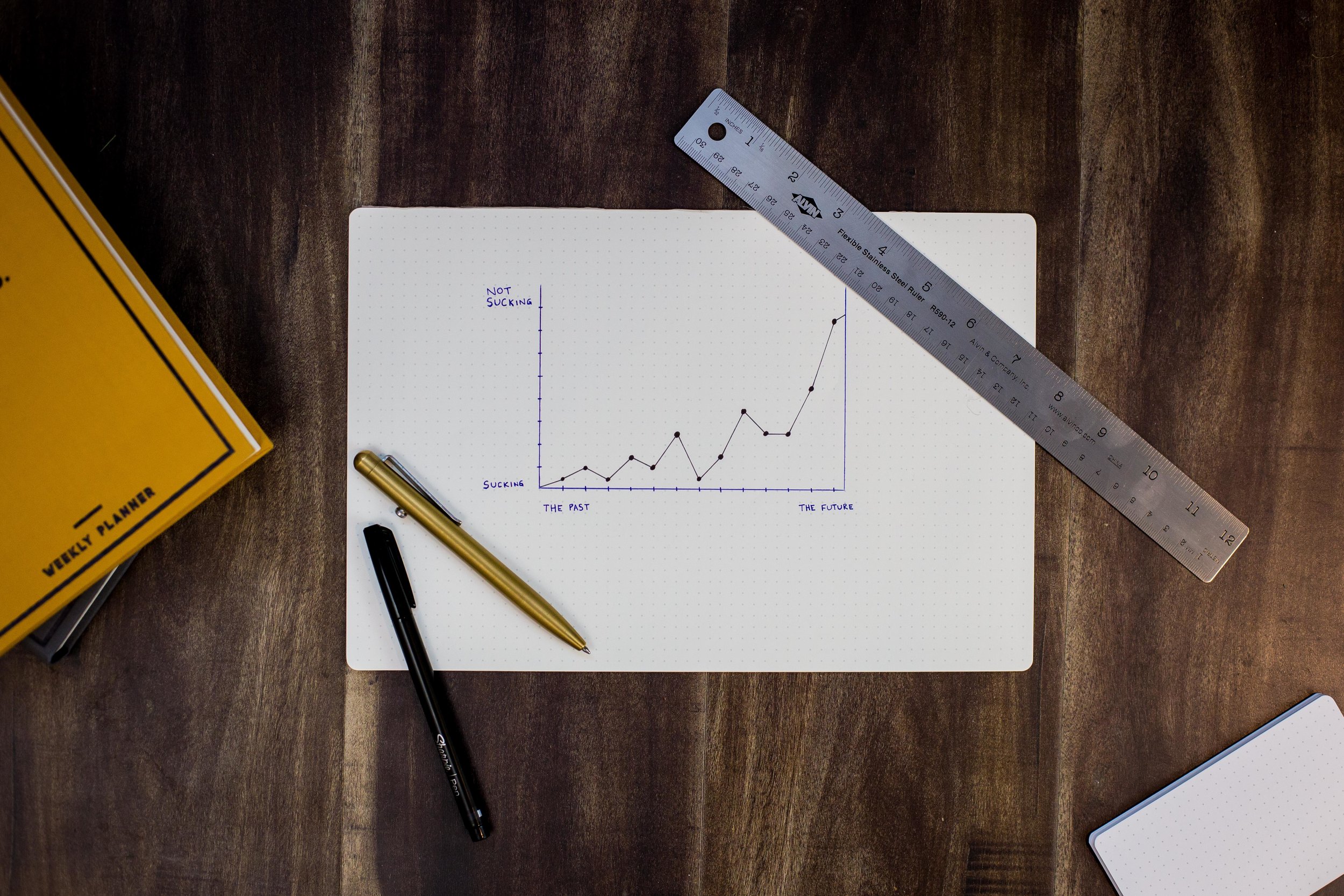

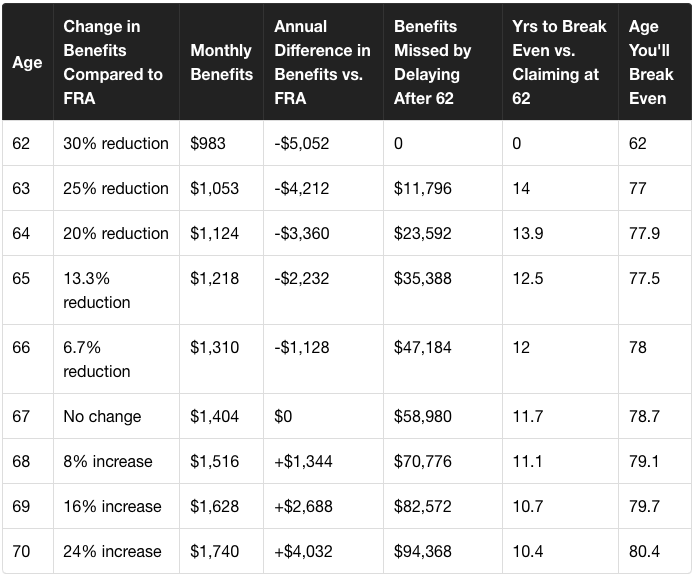

So how much can you save?

hi-chart

Some HSA’s also have an option to invest these dollars with the goal of growth for a later date, similar to a retirement plan. If you have access to an HSA don’t miss out on this great opportunity to save for future health care expenses.

2. Save accordingly- Control what you can control. • Start saving, keep saving and stick to your goals. • Take advantage of your company’s 401(k)! Sign up and contribute as much as you can. • Ask questions: call the 401(k) Advisors at Human Investing with questions regarding saving for retirement - 503.905.3100

3. Invest in yourself- Whether you plan to travel the world, spend time with family, or give back to the community you will need good health to achieve your goals and dreams. You can begin making healthy choices today by sticking to those New Year’s Resolutions, eating right and exercising. Invest in yourself - keep your mind and body active and healthy for years to come.

Just like geocaching, it’s necessary to make adequate preparation for your future, but unless you invest in yourself well it becomes difficult to finish strong in the race of life.