Why Save for College?

For many reasons, planning and saving for college is essential. The pursuit of a college education is a wise investment. In most cases, college graduates will earn significantly more over their lifetime than those who opt out of post-secondary education. However, this comes at a high cost. Beyond the purchase of a home, the decision to pursue higher education is commonly the second largest expense of an individual’s/family’s lifetime. Importantly, the inability to save and plan for college early can dramatically impact assets set aside for other savings goals such as retirement or paying off a primary residence.

You Can Fund Your College Tuition Out of Pocket and with Loans

Let’s say for whatever reason, funding college now for your child is not an option. The estimated annual cost of college at a four-year, in-state university is $27,000. When including inflation, from birth to sending a student away to college, total costs are estimated at over $190,000. Assuming you or your child, through student loans, need to borrow to fund schooling, the estimated cost balloons to nearly $250,000, which includes interest at 5% on the borrowed tuition over ten years.

Or You Can Start Saving at Birth

Using the same assumptions as before, but this time you pre-fund college (start now) over the course of 18 years at $6,000 per year. You should have just about enough to pay the balance of school. In short, the savings of $108,000 over 18 years, plus the growth of $88,500 (just over 6% compounded monthly), covers the cost of higher education.

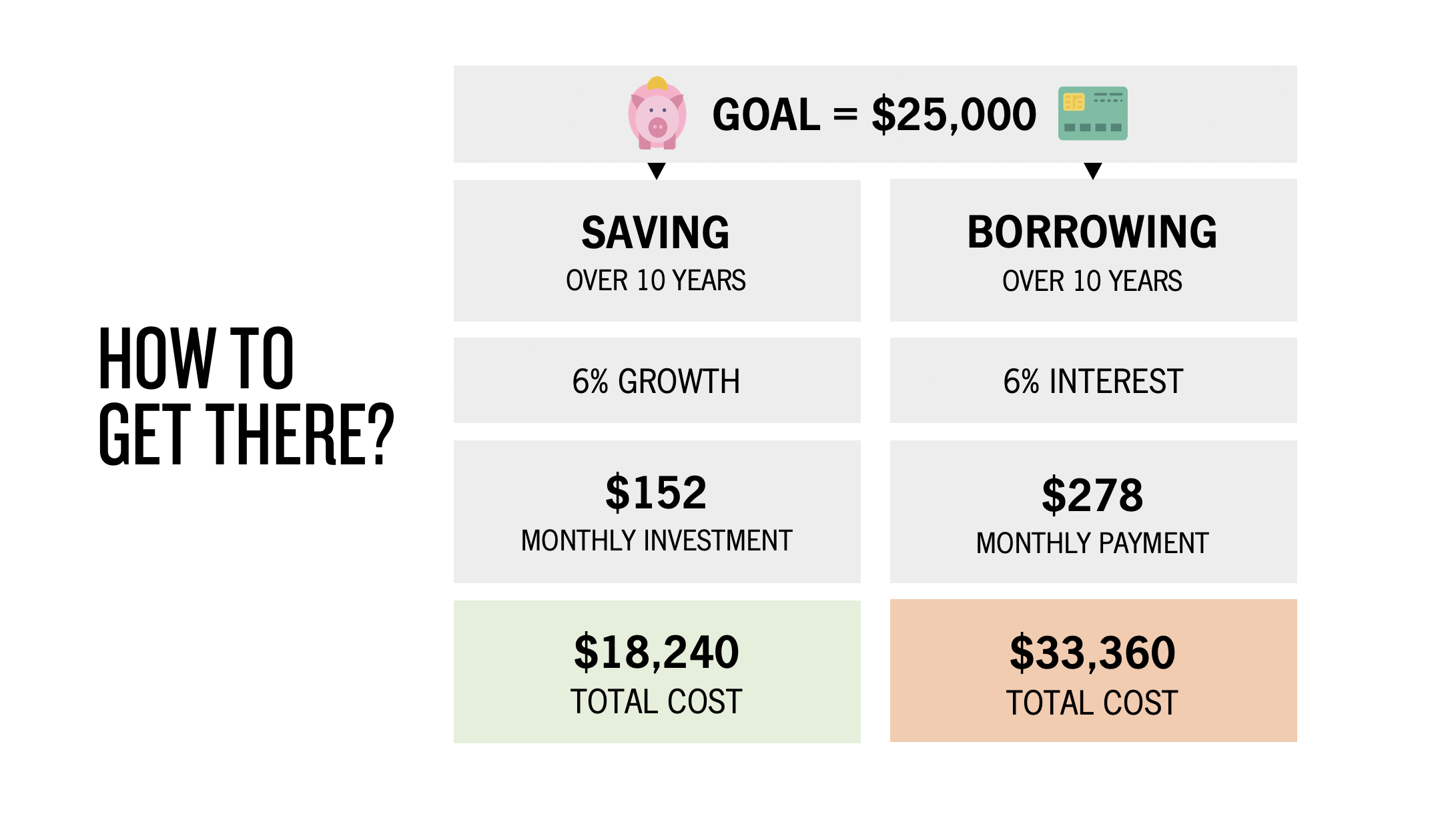

What’s the Difference?

Funding college early reduces the future funding liability by six figures. If there is an ability to pre-fund college, in whole or part, it is a great choice with lasting financial implications. By saving at the birth of a child or grandchild, a family could save approximately $140,000 per child ($250,000 versus $108,000), if they desired to fund 100% of college expenses at a 4-year, in-state university by saving to a 529 plan versus paying through student loans.

Paying with a home equity line of credit (HELOC), a student loan, or even out of present cashflow should be avoided if possible. Even less optimal is pulling funds from retirement accounts. Although sometimes necessary, taking retirement account distributions to pay for college will potentially increase your tax bracket and the could be subject to penalties. More importantly, it reduces assets available for your retirement when earning additional income is often difficult.

What are the Benefits of 529 College Savings Plans?

Your 529 Dollars Will Grow without Being Taxed. There are a plethora of benefits for a 529 account—but the most important is tax-exempt investment growth. If 529 funds are used toward qualifying education expenses (tuition, room & board, books, computer, etc.), there is no taxation on the earnings. If the college savings account has remaining funds after all tuition is paid, the parent or custodian could change the beneficiary to another family member or sibling. If there are no other beneficiaries to use the funds, the funds can be drawn out and used for anything. However, if designated 529 funds are used for the “anything” bucket, the growth on the account will be taxed at ordinary income levels and earnings will be subject to a 10% penalty.

If the student receives a scholarship, funds equal to that amount of the scholarship could be withdrawn from the 529 and not subject to a 10% penalty, but there would still be ordinary income taxation on the earnings withdrawn for purposes other than qualified education expenses.

Another benefit of a 529 plan is that it has a low impact on FAFSA, in qualifying for federal aid.

You Can Maximize Tax Credits. Depending on the state in which you live, there may be a state tax deduction for contributions to a state-sponsored 529 plan. For example, if you live in Oregon, you can receive a state tax credit of 5% of your contribution up to 100% of your contribution, depending on income limits. The maximum tax credit in any year is $300. There are also college tax credits on tuition that may be available depending on your income level.

It is important to coordinate the use of your 529 plan dollars with your tax advisor to maximize these potential credits.

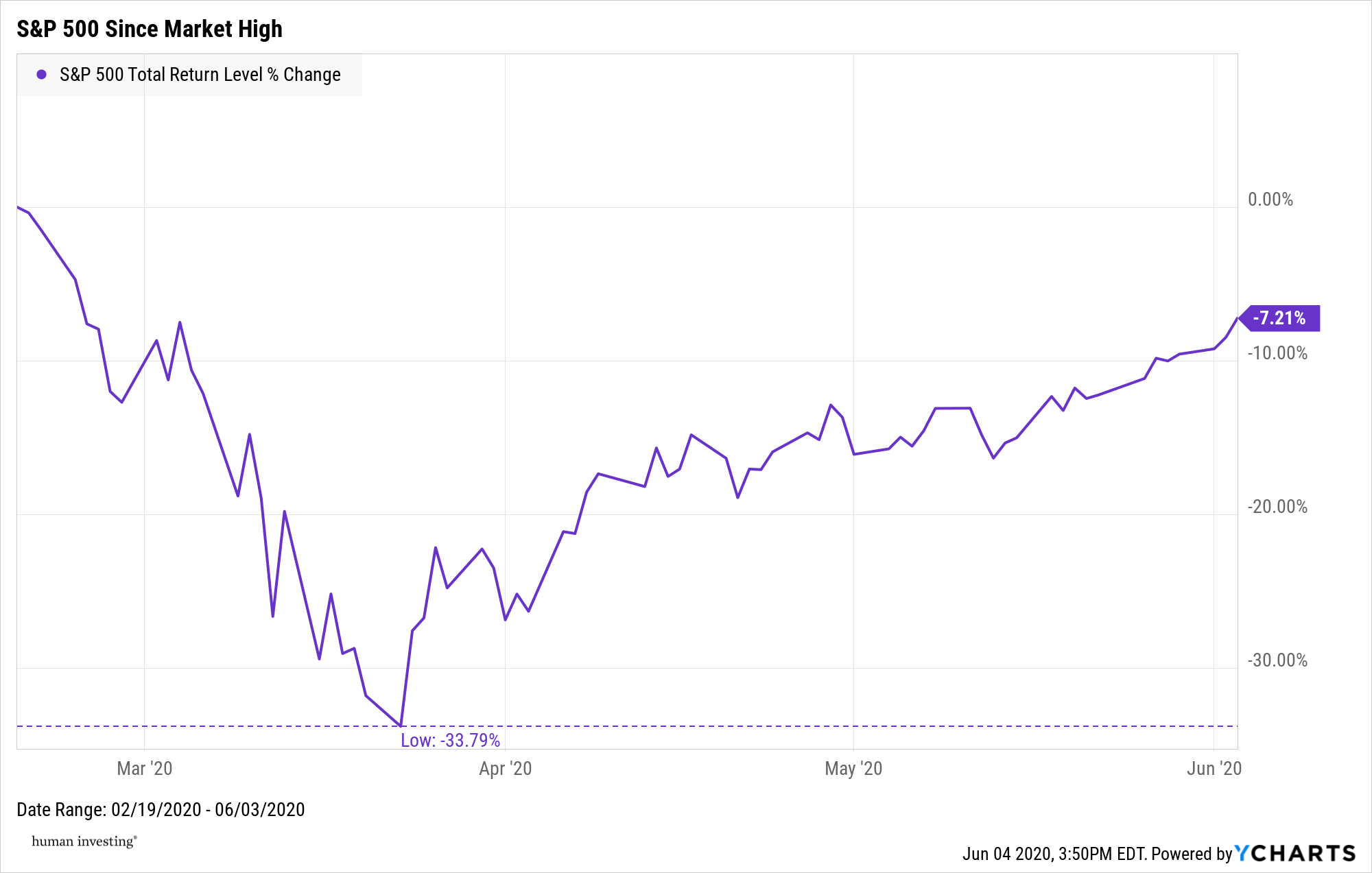

COLLEGE SAVINGS PLANS ADAPT AS YOUR CHILD APPROACHES COLLEGE

College savings plans have a shorter overall time horizon than a typical investment or retirement account. If an account is open when the child is born, 18 years will pass before funds are set for distribution. By the time the student is applying for colleges, funds should be invested more conservatively so as not to put funds at risk of loss at the time of liquidation and use for college expenses. As a rule of thumb, the earlier you start saving, the more aggressive you can be—but as college approaches, getting more conservative is a wise approach. This can often be solved with an age-based, target-date fund offered by 529 plans, in which the investments automatically adjust from stocks to bonds and cash as the child approaches college.

Talk about These Things During “Windshield Time”

There are many financial considerations when sending your children to college. Optimally, you and your significant other are making a choice early in life about how you hope to partner with your child in paying for school—if at all. If the choice is to help pay for some, or all expenses, discussions surrounding what paying for school looks like is essential.

Does paying for school include a two-year stint at a community college? What about a state school, private school, or a school of their choice? Each of these questions and considerations are great for a road-trip—something we like to call “windshield time.”