Happy New Year from your team at Human Investing! We would like to help guide you in your 2019 New Year's resolution of saving appropriately. You may already know but the 2019 limits of how much you can save differs from 2018 amounts. See below for your 2019 contribution limits. Human Investing is here to help make sure you are maximizing your retirement savings. Give us a call 503.905.3100 with any questions. Click here to be directed to the IRS website for further information.

In my last post, I wrote about the positive impact of financial planning on an investor's ability to stay in the market and manage the cognitive bias of loss aversion. In this post, I want to address recessions, market performance, and the cognitive bias of "recency." Recency bias occurs when an individual is more inclined to remember something that happened more recently than what may be recognized years before, creating a bias.

Economic Slowdowns and the Market

Several times in the last few days I have heard a stock market prognosticator suggest an economic slowdown is upon us. So, what is a slowdown or “recession”? Technically speaking, a recession is two consecutive negative quarters of GDP growth. Importantly, recessions are not uncommon and do not necessarily coincide with a decrease in the stock market.

While examining the chart below, the first column highlights the last nine recessions. The next five columns track the corresponding stock market performance for one year before the recession, the stock market return for the length of the recession, along with one, three, and five-year performance following the recession. In my view, the data is quite interesting and full of surprises.

Recency Bias

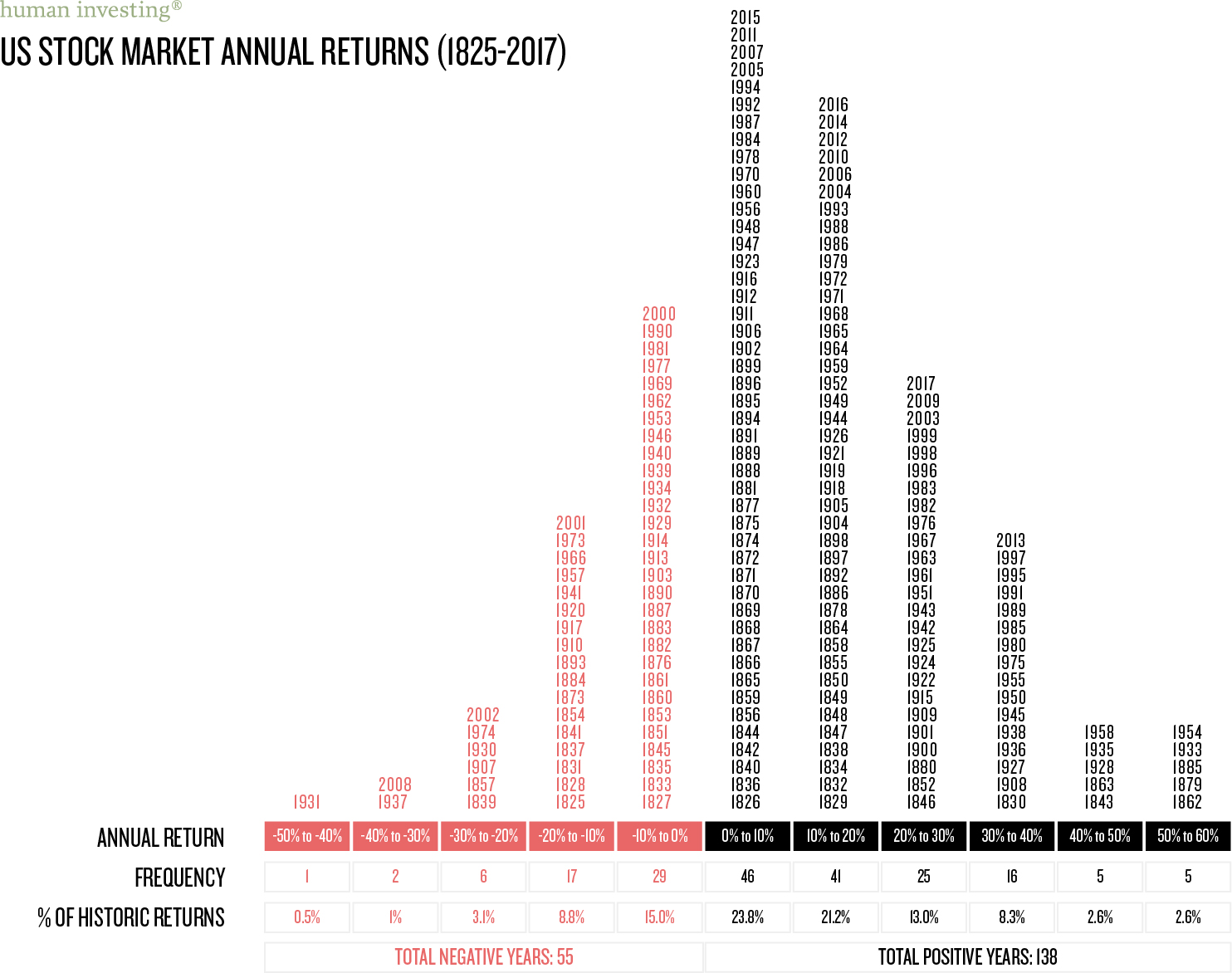

Recency bias, as mentioned above, clouds an investor’s understanding of complete market data. As such, with the last two most recent recessions having had a negative 35.5% and 7.2% respectively, investors are more likely to believe all recessions have comparably negative returns—this is in fact not true.

Although recessions and market volatility are unnerving, it is both normal and part of the price we pay for the opportunity to achieve fantastic long-term returns. We encourage you to focus on the financial plan which offers investors the best odds of achieving financial success.

Related Articles

In order to achieve retirement readiness, financial planning should be the focus of most individuals and families. Indeed, knowing how much a household needs to save and invest in producing a suitable level of income at retirement makes much sense. At the same time, given the recent uptick in market volatility, I have noticed additional benefits. Clients who have gone through the financial planning process appear to be at greater peace with the stock market gyrations. Further, when focused on executing their plan and not mentally tethered to the markets, clients are less prone to letting their behavior negatively impact their long-term performance.

Much of the time, financial planning does a great job of identifying how much an individual or family should own in both "safe" and "risk" investments to meet short-term cash and safety needs, as well as long-term growth objectives. In the absence of a financial plan, investors are left to wonder if they have the right mix of investments. Moreover, when market volatility increases, they are often the first to let their emotions get the best of them. Absent a financial plan; the focus is on the stock market. If the focus is on the stock market, and the market is temporarily going down, the pain of the volatility or what psychologists call "loss aversion bias" is too much to handle. As a result, at exactly the wrong time and for the wrong reason, we get a call to "sell everything" locking in those temporary losses—only to see the market recover as the investor sits on the sideline wondering when to get back in. Selling into a market that is going down is a significant reason investor returns and market returns are so different.

Dalbar, Inc. tracks investor return versus market returns, and the results are eye-opening. Our observation is that much of the gap between the long-term investor return and the long-term market returns are due to poor behavior and investors lacking a financial plan. In our view, having a financial plan is paramount as it gives a leg up to investors in two ways: 1) it helps center the discussion about money around goals and 2) it allows investors to minimize their dependence on monthly, quarterly, and annual stock market swings while redirecting the discussion back to goals-based planning. Goals-based planning is just a discussion on how many dollars will be needed and in what timeframe—this process alone will help determine the amount of safe versus risky investments.

Finally, comprehending the odds of success or failure in the market may be a massive help in keeping nerves at bay and focused on the things that matter most. Although the legal language would point us towards a statement about past performance being no indication of future success, we can look at the distribution of returns in the stock market going back to 1825 and feel very good about the chance of a positive outcome. It all adds up to 71.5% of the time the stock market has been favorable, in spite of many ups and downs in between.

Related Articles

I’ve never really minded flying. I enjoy the anticipation of going somewhere, the people watching, the exhilaration as the wheels leave the tarmac, the only occasion on which I will order a ginger ale. As I settle down into a book or movie, at some point I forget I am at a cruising altitude of over 30,000 ft. I forget until inevitably the plane lurches, my stomach drops and my nerves are rattled as the flight encounters turbulence. When experienced, turbulence can cause even seasoned travelers to lose their cool demeanor as they begin planning their exit strategy if worst comes to worst. When investing even the most seasoned investors can have a similar response when experiencing volatility.

Whether investing or flying, it is important to ask 3 questions: WHERE ARE WE? WHERE ARE WE GOING? WHAT IS NORMAL?

WHERE ARE WE?

Since 2009 the S&P 500 has taken off, up over 200% (As of 12.31.2018).

However, 2018 has provided turbulence for investors that have caused questions about how to navigate.

WHERE ARE WE GOING?

Once we assess where we are, it is important to focus on where we are going. Each flight has a flight plan and in that flight plan a destination. It’s important to know where you’re going whether in an airplane or with an investment account. Asking yourself, “What are these dollars for?” is a great way to assess your plan and savings timeline.

Do you need to save for this year’s holiday season to avoid taking on an additional $1k in debt?

Are you saving for the down payment of a home in the next 3-5 years where a high-yield savings account may be appropriate?

Are you saving for retirement where the time horizon is 10, 20, 30, 40 years in the future?

Knowing where you are going can help calm nerves on a plane or in financial markets and may also prevent you from abandoning ship before you get to your destination. No matter your goal or timeline it is appropriate to have a plan. It is also essential to check in to make sure you are staying the course. Sometimes this takes a call to ground control to assess.

WHAT IS NORMAL?

Finally, What’s normal? “From our perspective, turbulence is, for lack of a better term, normal,” said commercial pilot Patrick Smith, host of AskThePilot.com. Comforting to know from someone who spends their working days with their head in the clouds. Like turbulence, market volatility isn’t comfortable yet it’s normal.

What’s normal in the financial markets? Over the last 38 years, the S&P 500 has shown a positive annual return in 29 times. Meaning 76% of the time the market has finished positive on the year despite intra-year volatility and declines.

Source: ImageFactSet, Standard & Poor’s, J.P. Morgan Asset Management - Guide to the Markets.

Returns are based on price index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2017. Over this time-period the average annual return was 8.8%. U.S. Data is as of October 31, 2018.

So what we are experiencing in 2018 is normal and with an average annual return over the last 38 years at 8.8% there is a strong case for the long-term investor to be disciplined and stick to the plan.

In summary ask yourself (or ground control):

Where are we?

Where are we going?

What is normal?

These questions can help stay the course and not panic, even when your stomach drops. If you find yourself traveling this holiday season and need additional help overcoming a fear of flying see this practical guide. If you find you are flying toward retirement and find you need help building a financial plan lets us know, Human Investing is happy to help.

Effective September 22, 2018, a new federal law requires credit bureaus to allow consumers to freeze their credit for free.

On May 24, 2018, President Trump signed the Economic Growth, Regulatory Relief and Consumer Protection Act, which requires the three major credit bureaus: Experian, TransUnion and Equifax, to allow consumers to freeze their credit at no cost.

A credit freeze prevents other people or institutions from pulling credit information on an individual. Effectively it keeps identity thieves from opening a new account or loan in a person’s name.

This new law passed by Congress came after Equifax had a major data breach in 2017 that exposed personal information of 143 million Americans. Hackers were able to steal sensitive information which included addresses, dates of birth, Social Security, driver’s license and credit card numbers.

How a Credit Freeze Works

The process requires contacting all three credit bureaus, Experian, Trans Union and Equifax, to request a credit freeze. The credit bureaus will then provide a PIN which should be kept in a safe and secure location.

If credit is needed to process a loan, the individual or couple will then have to unfreeze their accounts by contacting the three credit bureaus and providing the assigned PIN either over phone or online. Keep in mind that it can take up to 3 business days to unfreeze credit.

In the past, it could have cost a couple up to $216 to freeze credit, unfreeze it to get a loan, and then refreeze their credit again. Now that this is free, it makes a credit freeze a more reasonable strategy to help prevent identity theft.

Should you do a Credit Freeze?

Freezing your credit can be time consuming, but it keeps others from opening new accounts in your name. However, if you check your credit annually and you intend to borrow from new lenders, it might not be worth the hassle.

If you want to ensure that one significant avenue of ID theft is protected, it can be a great idea.

While a credit freeze does keep others from opening new accounts in your name, it does not solve all ID theft issues.

Changes to Fraud Alert

The new law also extends a fraud alert on a credit report from 90 days to one year. A fraud alert requires lenders to verify the identity of the individual before issuing credit. Unlike the credit freeze, a single request to one credit bureau is all that is needed. The one credit bureau is required to communicate the fraud alert with the other two.

A fraud alert does not freeze the credit, but it makes it much more difficult for a thief to open a fictitious account.

Freezing credit or relying on fraud alerts are two possible steps in protecting your ID against potential financial loss.

Additional Ways to Protect Yourself from Identity Theft

1. Use strong passwords

- Use different passwords for each account

- Create unique passwords, no family names

- Change passwords frequently

- Consider a password manager

2. Set up two-factor authentication

- This requires an account to take a second action to verify account holder making it much more difficult for a thief to get into one of your accounts

- Turn this on for all financial accounts: bank accounts, credit cards. etc.

3. Keep all devices secure

- Use screen locks, pins and passwords for all computers, tablets and phones

- Enable encryption for stored data

- Avoid public Wi-Fi for any account transactions or purchases unless you have a separate VPN (Virtual Private Network)

- Always use security software with firewall, anti-virus and anti-malware

- Keep your smart phone secure, it is often where your second-factor codes are sent

4. Sign up for alerts on accounts

- Most online accounts will send alerts to your phone or through email when used

- This is especially important for credit cards and bank cards that are subject to skimming - where thieves steal your card information and sell it or use it

5. Keep personal information secure

- Shred receipts, credit applications, medical records, anything that has your personal information

- Limit the use of your Social Security number

- Keep your financial documents safe at home, at work and in public

6. Be alert to imposters

- Don’t give out personal information on the phone, over the internet or by mail unless you know the company and the purpose for the information

- Don’t respond to emails asking for personal information. If a company requests your information on line, do not respond to the email but go directly to the companies’ site or call the customer service number on your statement

7. Whether you freeze your credit or not, check your credit report

- Get a free credit report annually

- Consider using a credit monitoring service that alerts you to new accounts

8. Remember to consider all family members

- Don’t forget your children. Be alert. If your child gets a tax notice, a bill collection call or a credit card application it might be a sign someone is using their ID. Get a credit report before they turn 16. It should be blank, but you have time to get it cleared up before they need credit if something is in error

- Be careful of elderly family members that might not know how to prevent ID theft. If it does happen to them, they often feel ashamed and do nothing about it. Since the elderly are prime targets, having a plan for them is essential. A best practice is having multiple family members monitor their financial records on a regular routine

Identity theft happens to millions of people every year. Taking these measures does not guarantee your ID will not be stolen but it does put you and your family in a place to minimize the chance of it happening. If an issue does come up, you will be more likely to identify it and be able to respond quickly.

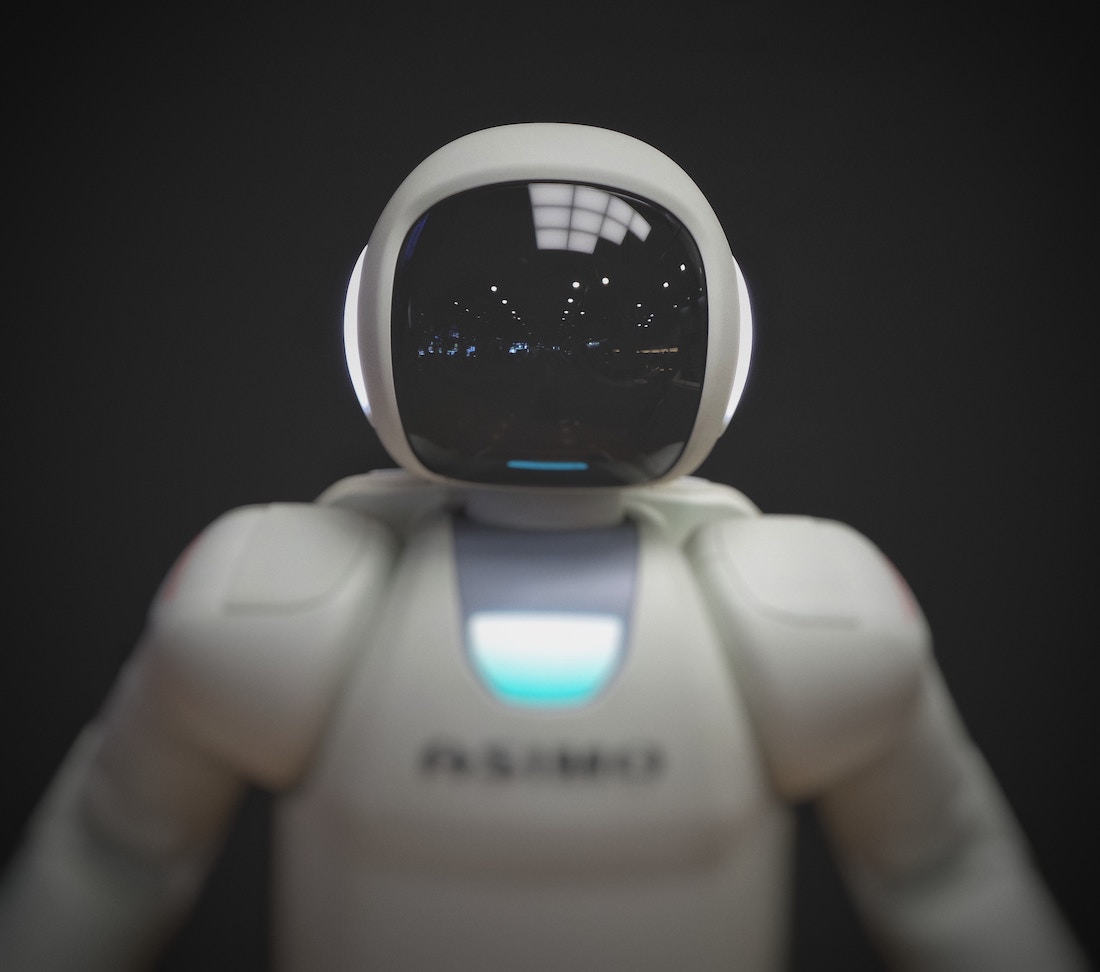

There is something intriguing about having a domesticated robot like C-3PO (Star Wars), Number 5 (Short Circuit), or Wall-E (Wall-E) to help with everyday tasks that while important are hard to find time to complete. Today our cell phones notify us with the time it will take to get home, refrigerators send us shopping lists (that is if no one is shopping for you) vacuums clean our homes, cars park themselves and it seems as though one day they will all drive themselves. In this day of helpful technology here are three simple tools to automate your finance.

Auto Increase: Auto Increase can help you reach your retirement savings goals without breaking the bank. It’s essential for most people to save at least 15% of their gross income for retirement, however, this can be difficult. If saving 15% is inconceivable, start small and use automation to help. Some retirement plans allow you to set up an annual increase of your contribution percentage. Increasing your savings rate by just 1 percent each year can have a powerful impact on your retirement balance.

Example: A 35yr old with an annual income of $50k begins saving 5% into her 401k by age 65 she can expect to have a balance of $335k. Now if she were to set up an annual auto increase of 1% she could increase her retirement balance to over $825k.

A 1% auto increase can add almost $490k to your retirement balance!!!

Source: dinkytown.net

Hint: Set up your auto-escalation to coincide with the time period you typically get a pay increase. This strategy will help decrease the impact on your bank account.

Auto Rebalance: Setting up auto rebalance can help you avoid unnecessary risk in changing markets. With stocks up 13.57% and bonds up 2.59% annualized over the last 5 years (see graph), you could be taking on some additional risk with an out of balance retirement account. Automating your account or taking the time once a year to rebalance your portfolio can help disperse some of this risk.

Example: Say five years ago an individual had $20,000 in their retirement plan and purposely invested 50% of their portfolio in stocks and the other 50% in bonds, a 50/50 ratio. Over the last 5 years, this account would have grown by 51% to over $30k. In the short period, the purposeful 50/50 portfolio would now be a 62/38 ratio of stock to bonds. This change in the stock/bond ratio can alter the individual’s portfolio and add additional risk.

The graph below highlights the growth of $10,000 invested in the Vanguard Total Stock Market Index Fund Admiral (VTSAX) compared to the growth of the Vanguard Total Bond Market Index Fund Admiral (VBTLX) from August 2013 until August 2018. $10,000 invested in stocks (VTSAX) would have grown to almost $19,000 while $10,000 in a bond fund (VBTLX) would have grown to just over $11,000.

Source: Morningstar.com

Automate your Emergency Reserve: American’s now have more credit-card debt than ever, passing the $1 Trillion mark, paying an average of 17.03% interest. To help avoid being stifled by such expensive debt it is important to build an emergency reserve. Building an emergency reserve of at least 6 months of your income can help keep you on track when unexpected expenses come up. Banks’ digital presence makes it easier than ever to automate saving. Rather than waiting to the end of each month to see what’s left over, if you know you get paid on the 1st of the month set up an automatic transfer to your emergency reserve on the 2nd day of the month. Setting up the automatic transfer helps force yourself to be more strategic with your dollars.

Conclusion: Whether you are wary of robots taking over or are excited to pawn off the mundane (like these robots that open doors), taking a few minutes to set yourself up for success can point you and your family in the direction of financial wellness.

And while Artificial Intelligence can help with much, it can never replace the value of a face-to-face interaction. At Human Investing, our team of world-class humans aim to serve your pursuit of a fuller life with tailored financial planning and advice. This goes beyond the “nuts and bolts” of investing and financial planning and into the heart of why we do what we do.

Related Articles

(Reprinted from the Nonprofit Association of Oregon)

How you can build and fortify your donor base

With the recent Tax Cuts and Jobs Act of 2017 – which became effective January 1, 2018 – there’s concern that the increase in standard deduction will dis-incentivize donors who will no longer receive a tax deduction for their charitable giving. This could pose a challenge to nonprofits who rely on consistent donor funding – and it’s not to be discounted. However, while it’s true that a charitable tax deduction is an incentive, it’s not the only reason people give. Northwesterners in particular love their nonprofits. They care deeply about communities, they care about causes and they give in increasing numbers. We’re encouraging nonprofits to plan, be proactive and make sure donors know the impact of their investments. Importantly, this could be an opportune time to modify your fundraising perspective and consider new ways to energize your donor base.

Qualified Charitable Distributions from an Individual Retirement Account

One consideration is to inform your donors who are 70.5 years or older that they are eligible to make charitable contributions from their tax deferred Individual Retirement Accounts. Retirement account holders may distribute up to $100,000 per year, including their Required Minimum Distribution, directly to a nonprofit and avoid taxes on the distribution. These distributions avoid ordinary income tax but also reduce the potential income tax liability on Social Security and may lower Medicare premiums.

Donor Advised Funds

Another opportunity exists for nonprofits to further understand Donor Advised Funds and inform their donor base about the benefits. A DAF is a vehicle where a donor can make a charitable contribution, immediately receive eligible tax deductions and then distribute donations to one or multiple nonprofits of their choice in any time frame. The contributions can be invested and any potential growth is tax-free. Additionally, donors may contribute both cash and non-cash gifts to a DAF.

With the standard deduction now doubled, donors may find that itemizing doesn’t make sense in 2018 and beyond. One tax-planning strategy called “bunching” can help donors maintain their charitable deductions. They may contribute multiple years of charitable giving in one year to surpass the itemization threshold, and in off-years take the standard deduction. Please see the example below. A DAF can operate as a central location to receive, invest and distribute the contributions.

Accept Non-Cash Gifts

Finally, nonprofits should consider providing a method for non-cash donations such as stocks, real estate or other assets. This can be particularly advantageous when the donation is an appreciated asset that has been owned for one-year or longer. In this case, the donor is able to receive a tax deduction for the entire value of the asset while avoiding long-term capital gains from the sale of the asset.

If these types of donations cannot be supported by the nonprofit, a DAF will likely handle the transition and sale of the asset and then the contributions to the donor’s nonprofit of choice.

This is an opportune time to seek out donors who may be looking for creative tax-planning strategies. While this information may be helpful, please consult your CPA for specifics about how these tax strategies will affect your nonprofit organization and donor base.

Human Investing is a certified B-Corporation, a member of NAO and an Oregon-based financial firm serving the financial pursuits of both nonprofit organizations and individual donors. If you would like to learn more, we’d love to hear from you.

Despite the recent awareness around fees in today's environment, it can still be challenging for investors to know what and whom they are paying.

I was reminded of this recently when we had the pleasure of welcoming a family in as new clients to our firm. When they first reached out to us, they knew something was not right with their investment situation. After reviewing their statements and a discovery call, we quickly found out why. They were being overcharged and underserved. It turns out their fees were roughly 2.12% per year. At the same time, the level of service they were receiving included one phone call per year, online access and statements.

In this article, my goal is to unwrap the fee structure that this family experienced, highlight the long-term negative impact and then provide an awareness that can help you avoid this situation.

Moreover, while this article focuses on the experience of a single family, we have seen the same cost structure apply directly to institutions as well, whether an endowment, foundation, ERISA retirement plan or other types of institutional assets.

The step-by-step on how to give up 25% of your market returns to your advisor (not recommended!)

The family mentioned above did not realize they were charged fees on fees. One layer included an advisor fee of 1.40% per year with limited services. Unfortunately, industry expertise, full client engagement, risk management, along with estate and financial planning were not part of the offering.

The second layer of fees was the underlying costs of the investments held in the portfolio—which was new information to the clients. Even though they had a diversified mix of “institutional” mutual funds in their account, the average expense ratio of these investments was 0.72%, which was added to the 1.40%.

Without digging deeper into other potential underlying fees such as trading costs and custodial fees, the total costs were 2.12% per year. (1.4% + 0.72% = 2.12%)

Assuming a 9% long-term average return(1) in the stock market, these clients had been giving up almost 25% of return per year in fees. Unless there is some other form of benefit or return the client is receiving, this is retirement money down the drain. In Peter Fisher’s 2018 article in Forbes titled, “Why Conflicting Retirement Advice is Crushing American Households,"(2) he points out that the annual cost of conflicted investment advice in the US is $17 billion per year. The scenario outlined in this article is case in point.

The Negative Compounding Effect of Fees

The diminishing effects of the high fees & low service model outlined above are significant. To illustrate, I have provided a compare-and-contrast to what I believe is a more reasonable fee structure of 0.85% in total fees. (This includes an advisor fee of 0.75% and underlying investment fees of 0.10%.)

After backing out the fees for both scenarios, the difference in future account value after 20 years of saving and investing is $343,000.

If you are an institution, add a zero or two to the end of each number for a better comparison on the effects to your business, organization, non-profit, endowment, foundation, or other.

Is the “advisor” adding $343k worth of value? That amount would more than cover health care costs for a married couple throughout their retirement years, according to recent studies(3).

To be clear, advisors can add significant value to a client relationship. Vanguard produced a research piece called the Advisors Alpha®(4) that makes the case that an advisor can add significant value beyond the fee they charge. However, it comes through a combination of wise stewardship and planning, portfolio construction and tax efficiency. In short, it is much work that deserves fair compensation. The challenge with the scenario outlined above is that any advisor would have difficulty justifying their value at that fee level when their only service is setting up an allocation and checking in once a year.

How You Can Avoid This

Having open and honest communication with your advisor is essential. Here are a few questions to ask that can help you determine if your advisor is acting in your best interest and has a compelling service and fee offering:

Fees & Services: What services will I receive and how much will it cost?

Service and fee schedules should be clearly outlined so you can determine what you are receiving and how much you are paying. You will be able to measure the potential "Advisors Alpha®." A contract should explicitly outline fees and the commitments being offered such as discretionary investment management, planning services, meetings per year, insurance reviews, risk management, estate planning, reporting and more. If you are an institution this will look slightly different, but it will still be the same idea. If your advisor cannot tell you exactly how they are going to serve you and what their charges will be, it might be best to keep looking.

Investment Fees: What is the fee for the underlying investments held in my account?

This question will help you asses the total fee that you will be paying and not just the advisors fee. Typically these investment costs can be minimal for accounts that use individual stocks, bonds, Exchange Traded Funds (ETFs) and index funds. However, for accounts that use actively managed mutual funds, insurance products or Separately Managed Accounts (SMAs), these fees can add up and take a toll on your long-term return.

Are you a Fiduciary: Are you a legal, written Fiduciary in all matters?

If your advisor is not a legal, written Fiduciary in all matters, beware that they have the flexibility to not apply Fiduciary standards in serving you. If they are a Registered Representative, Investment Representative, Broker or Insurance related, there’s a good chance they do not have to act in your best interest.

Are you an Expert: Do you have credentials or an advanced degree in your field of practice?

Your advisor should continue to learn and grow throughout their career. Legally, all advisors and brokers must have individual licenses such as the Series 6, Series 65, Series 7, etcetera. This does not make an advisor an expert. It is merely the cost of admission and is the SEC and FINRA's attempt to ensure there is some form of standard in the industry. Look for credentials such as CFA, CFP, CPA, or CIMA and for advanced degrees such as Master’s in Financial Planning or Master of Science in Finance. In short, credentials and advanced degrees help demonstrate the continued efforts of an advisor to learn and stay on top of trends in an incredibly complex and dynamic profession.

If you have questions about this article or any personal or institutional financial needs, we would love to help. Please do not hesitate to reach out to our team.

(1) According to the Chicago Booth Center for Research in Security Prices, from 1/1/1926 to 12/31/2017 the compound annual returns for US stocks were 10.0% and for international stocks, 8.0%. In this article, I have assumed an arbitrary and straightforward 9% average return solely for illustration. This does not constitute investment advice and should not be relied on as such. http://www.crsp.com/resources/investments-illustrated-charts

(3) https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

Related Articles

Oregon College Savings Plan: Examining the New Changes and Existing Opportunities

Recently, there have been two significant changes that affect the Oregon College Savings Plan (one of the Oregon state-sponsored 529 plans). This presented an opportunity to share updates and examine commonly overlooked planning opportunities.

Background and Highlights on 529 Plans and Oregon College Savings Plan

529 Plans are State-Sponsored Education Savings Accounts (The Oregon College Savings Plan is one of the available Oregon-sponsored Plans)

Tax Advantages of 529 Plans: Taxation Similar to Roth IRA

After-Tax Contributions

Tax-Free Growth

Tax-Free Distributions if used for qualified education expenses

If funds are not used for qualified education expenses, the investment growth is subject to ordinary income taxes and a 10% penalty.

Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan: Oregon state income tax deduction is available for contributions up to $4,750/year (Married filing jointly) and $2,375/year (all other filers) for 2018. Note: This amount will typically see small increases each year for inflation.

New Plan Manager for The Oregon College Savings Plan

The Oregon College Savings Plan recently decided to change to a new plan manager and the transition is scheduled to be complete by September 12th. Earlier this year at a local meeting for the Financial Planning Association (FPA) of Oregon & SW Washington, we were able to hear directly from the plan advisor about the anticipated changes, including the details on their thought process and analysis. After learning more about these changes, they appear to be positive improvements that should help the plan and plan participants.

Highlights of Plan Changes Include:

Cost: Currently the fees will be approximately the same as the previous plan, but a new fee structure will allow for the costs to decrease in the future as the plan grows.

Investment Funds: The investment fund lineup has been revamped and now includes additional lower-cost fund options from well established and respected fund companies like Vanguard and DFA.

Changes to Age-Based Funds: The previous plan manager had an option to select an age-based portfolio (blend of funds to match the time horizon for college). The new plan manager improved and optimized this option by doing the following:

The old plan used an Age Group (i.e. Age 0-4). The new plan will utilize College Start Date instead since the actual enrollment age can vary.

The old plan assumed an investment time horizon that ended at age 18. Since college typically extends through age 21-23, the new option expands the investment time for horizon through the end of college.

The new plan changes the process for making the portfolio more conservative over time as the beneficiary gets closer to college. It will now be more gradual and efficient which can mitigate the risk of selling the stock portion of the portfolio on a down market day.

Navigating the New Rule Change for K-12 Expenses

Previously, K-12 private school expenses were not qualified education expenses under a 529 plan. The recent Tax Cut and Jobs Action of 2017 Tax Act now treats withdrawals for up to $10k/year for K-12 expenses as qualified education expenses.

Oregon did not extend favorable tax treatment for K-12 expenses. If you take distributions from K-12 expenses, Oregon state income tax deductions previously taken for contributions will be added back to taxable income. In addition, any investment gains will be subject to Oregon state income tax.

The Oregon treatment of this new rule makes it less attractive as a planning strategy for K-12 private school but could still be a viable option to consider under the right circumstances. If your family cash flow has become tight and private school costs have become stressful for your family, using 529 plan funds could be worth the relief since the tax consequences are now lower.

For example, you have a non-Oregon 529 Plan where you contributed $8,000 and the account balance has grown to $10,000. If you withdrew the $10,000 for K-12 private school, you would pay approximately $200 in Oregon taxes ($2,000 gain at 10% = $200).

What are the Planning Opportunities and Considerations with the Oregon College Savings Plan?

Rollover Tax Savings Opportunity: Do you have an existing 529 Plan sponsored by another state? There is an opportunity to rollover this plan into the Oregon plan and capture immediate savings in Oregon state income taxes even if you don’t make any additional contributions.

State Income Tax Deduction Planning: Are you taking full advantage of the Oregon state income tax deduction? There are other considerations other than contributing the deductible limits each year. Examples include: Planning around contributions over the deduction limit that can be carried forward and used in future years (subject to limitations). Also, it may not be too late if your child is very close to or currently in college. Contributing funds even if it is for the short-term can still create state income tax savings that you could be missing out on.

Be Conscious of Federal Gift Tax Limits: Contributions to a 529 plan are considered gifts and can be subject to gift tax if above $15,000 per donor ($30,000 for married), per beneficiary each year (2018). Gifts above those thresholds can avoid gift tax but may create added cost and inconvenience of filing a Gift Tax Return. If you recently received a sum of money like an inheritance, it could make sense to spread the contribution over a few years instead of making one large upfront contribution.

Special Needs: If you started a 529 plan and there is a possibility that your child may not be attending college due to special needs, there is an opportunity to roll that account into an ABLE Savings Plan (tax-advantaged savings plan for individuals with disabilities that does not affect their government benefits). This opportunity is subject to rules and limitations. For more information click here https://oregonablesavings.com/.

If you want more information or have any questions:

If you have questions or would like more information you can visit www.oregoncollegesavings.com or contact Human Investing through our website at https://www.humaninvesting.com/contact-us/

Looking to go on a “once and a lifetime” vacation to Fiji? Renovate your kitchen? Upgrade your car? Did you know you may be able to utilize your 401k or other retirement plan to take a loan to help finance this big expense? Here are the details, the dangerous reality, and things to consider when taking a 401k loan:

The Details:

If your plan document permits, a 401k loan can help you access up to $50k of likely your biggest pool of assets, avoid creditors, pay interest back to yourself (typically prime rate + 1%) and there is no need for good credit to qualify. You wouldn’t be the only one taking advantage of this opportunity; according to the National Bureau of Economic Research, about 1 in 5 active participants have a 401k loan.

NBER Working Paper No. 21102

The Dangerous Reality:

Does all of this sound too good to be true? Well, it just might be. A 401k loan can come at the cost of hundreds of thousands of dollars in future retirement income (see graph below). So, whether you have a loan or are planning to take a loan, it is important to know some of the dangers of borrowing against your future self:

Forfeit the tax advantage of your retirement plan dollars - When you are paying back your loan, interest payments are done so after tax. This forfeits the tax advantage of these retirement dollars as taxes are paid when you contribute and later withdraw.

Leaving your employer? Think again - If you leave employment at your company, whether by your choice or your employer’s, you will find yourself in a sticky situation. The remaining balance of the loan will need to be paid back by the time you file taxes for the current year. Defaulting on your 401k loan comes at a great cost. The remaining loan balance will be considered taxable income. If you are under age 59 ½, a 10% early withdrawal penalty will be tacked on as well.

Abandon free money – If your 401k has an employer match you may miss out on free money if you cannot afford to continue contributing to your 401k while paying back the loan.

Miss out on market growth - Your dollars are not fully invested while you have an outstanding loan balance. This means a portion of your portfolio would miss out on opportunity for growth, specifically when market returns are greater than the interest rate paid to yourself.

Detrimental impact on retirement income - A 401k loan can have a detrimental impact on your retirement savings and your potential income in retirement. The below graph shows the effects on an individual’s retirement savings and monthly retirement income. Three scenarios shown are 1) take a 401k loan and push pause on contributions; 2) take a 401k loan while continuing to save; and 3) don’t take a loan.

This graph is for illustration purposes only. It highlights the impact a loan has on an individual’s retirement balance and monthly retirement income after 30 years of investment growth during working years (assuming 7% annual market return and annual contributions of $7,500) and 30 years of income through retirement (assuming 4% rate of return). In this example an individual takes a $15k 401(k) loan from a $50k balance to pay down some bills and a finance a vacation.

The “once in a lifetime trip to Fiji” can ultimately cost more than $1,400 per month in retirement income.

That’s $515k over 30 years of retirement!

Options to consider:

For some, a 401k loan can be a helpful tool when “life happens,” allowing participants of retirement plans the ability to access a pool of assets intended for retirement. However, while this can be an attractive tool for some, borrowing from your future self can have its drawbacks. Either way, here are issues worth thinking about:

Want to go on a once in a life time trip to Fiji, or finance some other big expense that isn’t worth putting your retirement income in risk? Budget for future big expenses, plan and start saving today.

Building an emergency reserve (3-6month’s income) to keep you on track financially and avoid a last resort 401k loan when an unexpected expense comes up.

Are you in a pinch and need to take a loan or have already taken a loan? Continue saving in to your retirement account so as to not miss out on valuable retirement savings and possible employer match.

Want to take a 401k loan? Check with your HR representative or 401k advisor to see what options are available to you.

Related Articles

Many of the blogs that we post reference strategies on how to save for retirement and how many Americans need to save more than they currently are (or else you might end up like this.)

However, in addition to saving, many of us will be a recipient of a retirement account via a loved one or acquaintance passing away. Will Kellar and I had the idea to consolidate some good resources online and provide a road map for beneficiaries as they look to navigate best practices when they are on the receiving end for one of these accounts. In a season of loss, remember we are here to help navigate this difficult time.

You are listed as a beneficiary, are you the SPOUSE or OTHER?

You are a spouse listed as a beneficiary

Traditional, SEP IRA, or SIMPLE IRA

Option 1: Transfer the assets to your own IRA

Benefits

Dollars can continue to grow tax-deferred.

Designate your own beneficiaries.

Next steps

This option is only available if you are the sole beneficiary.

All that’s needed is to roll the funds into your existing IRA or open a new IRA to roll the funds into.

When is the money available?

You can access funds at any time, but a penalty will apply to distributions made before 59 ½.

After 70 ½ your account will be subject to normal required minimum distributions.

This might make sense when

If you are over age 59 ½ this option often can make sense because it provides flexibility on beneficiaries you can designate, you have the full ability to access funds. Additionally, if you are between 59 ½ and 70 ½ you might be taking yourself out of a Required Minimum Distribution (RMD) scenario.

Option 2: Transfer the assets to an Inherited IRA

Benefits

Dollars can continue to grow tax-deferred.

You will not have to pay a 10% early withdrawal penalty.

You can designate your own beneficiaries.

Next steps

You can transfer assets into Inherited IRA in your name.

If there are multiple beneficiaries you must establish a separate account by December 31st following the year of death in order to use your own life expectancy. If you miss this deadline RMD’s will based off of oldest beneficiary.

When is the money available?

You can access funds at any time.

Your life expectancy may be used to calculate RMD’s.

If the original account holder was under 70

RMD must begin by the later of:

December 31 following the year of the original account.

December 31 of the year in which the original account holder would have reached 70 ½.

If the original account holder was 70 ½ or older:

RMD’s must start by December 31st of the year after death.

If the original account holder did not take RMD for the year in which he or she died, you must take at least that amount as a distribution by the end of the current year.

This might make sense when

If you are under 59 ½. By transferring to an Inherited IRA you provide yourself flexibility in three ways:

You have the option to withdrawal funds penalty free based on your life expectancy. So if you would like the money over time this is a great choice.

You also have the choice to start RMD’s based on when your deceased spouse would have turned 70 ½.

If you are hoping to use all of the funds in the next 5 years there is a provision called the “5-year method” that allows for distribution of all funds without paying penalties over the first 5 years of the account being open.

Option 3: Lump Sum Distribution

Benefits

No 10% early withdrawal penalty (think of this as following the 5-year rule).

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

All at once.

Taxable portion of the distribution will be considered taxable income.

This might make sense when

You have an immediate need for the funds.

Qualified Retirement Plan (401(k), 403(b), etc.)

Option 1: Leave it in Plan (this is dependent upon plan rules)

Benefits

Dollars can continue to grow tax-deferred.

You will not have to pay a 10% early withdrawal penalty.

You can designate your own beneficiaries.

Next steps

You can transfer assets into Inherited IRA in your name.

If there are multiple beneficiaries you must establish a separate account by December 31st following the year of death in order to use your own life expectancy. If you miss this deadline RMD’s will based off of oldest beneficiary.

When is the money available?

You can access funds at any time.

Your life expectancy may be used to calculate RMD’s.

If the original account holder was under 70

RMD must begin by the later of:

December 31 following the year of the original account.

December 31 of the year in which the original account holder would have reached 70 ½.

If the original account holder was 70 ½ or older:

RMD’s must start by December 31st of the year after death.

If the original account holder did not take RMD for the year in which he or she died, you must take at least that amount as a distribution by the end of the current year..

This might make sense when

You are needing to by some time and do not have trusted place to open an IRA this is a great option. Ultimately, in our opinion having these dollars end up either in an IRA in your name or an inherited IRA often providing additional flexibility.

Option 2: Transfer the assets to your own IRA

Benefits

Dollars can continue to grow tax-deferred.

Designate your own beneficiaries.

Next steps

This option is only available if you are the sole beneficiary.

All that’s needed is to roll the funds into your existing IRA or open a new IRA to roll the funds into.

When is the money available?

You can access funds at any time, but a penalty will apply to distributions made before 59 ½.

After 70 ½ your account will be subject to normal required minimum distributions.

This might make sense when

If you are over age 59 ½ this option often can make sense because it provides flexibility on beneficiaries you can designate, you have the full ability to access funds. Additionally, if you are between 59 ½ and 70 ½ you might be taking yourself out of a Required Minimum Distribution (RMD) scenario.

Option 3: Lump Sum Distribution

Benefits

No 10% early withdrawal penalty (think of this as following the 5-year rule).

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

All at once.

Taxable portion of the distribution will be considered taxable income.

This might make sense when

You have an immediate need for the funds.

ROTH IRA

Option 1: Transfer the assets to your own IRA

Benefits

Dollars can continue to grow tax-deferred.

Next steps

If you are the sole beneficiary you can transfer funds into your existing or new ROTH IRA.

If you are one of multiple beneficiaries, you must take your share as a distribution and roll into a ROTH IRA within 60 days.

When is the money available?

You can access funds at any time.

Distributions are generally tax and penalty free if you are over 59 ½ or qualify for a penalty free exception and have met the five-year holding period. Schwab provides guidance if you are looking for what rules apply to you if you are looking to distribute funds.

This might make sense when

You plan to take distributions based on when you turn 59 ½ not the beneficiary.

Option 2: Transfer the assets to an Inherited ROTH IRA

Benefits

You bypass the 10% early withdrawal penalty.

Next steps

Transfer assets into Inherited ROTH IRA held in your name.

If there are multiple beneficiaries, separate accounts must be established by December 31st following the year of death in order to use your own life expectancy; otherwise RMDs will be based on the life expectancy of the oldest beneficiary.

When is the money available?

You can access funds at any time.

Any earnings are generally tax free if the five-year holding period has been met.

Your life expectancy may be used to calculate RMDs.

Annual distribution (RMDs) must begin by the later of:

December 31 following the year the original account owner died or

December 31 of the year when the original account holder would have reached 70 ½

You may also follow the five-year rule under which the account must be fully distributed by December 31 of the fifth year following the year of death.

Option 3: Take a lump sum distribution

Benefits

No 10% early withdrawal penalty.

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

All at once.

Distributions are generally tax and penalty free if you are over 59 ½ or qualify for a penalty free exception and have met the five-year holding period.

This might make sense when

You have an immediate need for the funds.

You are listed as a beneficiary, not a spouse

Traditional, SEP IRA, or SIMPLE IRA

Cannot roll over to your own IRA

Option 1: Transfer assets to an Inherited IRA

Benefits

Dollars can continue to grow tax-deferred.

No 10% early withdrawal penalty for distributions.

Designate your own beneficiaries.

Next steps

Transfer dollars to Inherited IRA, under your name.

If there are multiple beneficiaries you must establish a separate account by 12/31 to use your own life expectancy for Required Minimum Distributions (RMDs). Otherwise RMDs will be based off the life expectancy of the oldest beneficiary.

When is the money available?

Able to access dollars at any point. Dollars withdrawn will be considered taxable income. Here are some distribution options:

Cash out the IRA in 5 years, by Dec 31st of the fifth year since the retirement account owner’s death.

Take distributions over your life expectancy.

Take distributions over life expectancy of original owner.

Take Out Required Minimum Distributions Over the Oldest Beneficiary's Life Expectancy.

RMDs must start by 12/31 of the year after death.

If account holder was younger than 70 ½ and original account owner did not take an RMD for year of death, you must take this RMD amount for current year.

Notably, the requirement for a non-spouse beneficiary to take out a minimum distribution is only a minimum requirement the beneficiary may take out more, anytime he wishes.

This might make sense when

The non-spouse beneficiary would like to stretch inherited dollars, taking distributions over their life expectancy while allowing dollars to continue to grow tax deferred.

The non-spouse beneficiary is older than the original owner (who was not 70 ½ at death), it’s more appealing to use the decedent’s longer life expectancy.

Option 2: Lump Sum Distribution

Benefits

No 10% early withdrawal penalty.

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

Dollars available at once.

Taxable portion of the distribution will be considered taxable income.

This might make sense when

You have an immediate need for the funds. Note that by taking funds out all at once there is the potential to move into a higher tax bracket.

ROTH IRA

Cannot roll over to your own IRA

Option 1: Transfer assets to an Inherited Roth IRA

Benefits

Dollars can continue to grow tax free.

No 10% early withdrawal penalty for distributions.

Designate your own beneficiaries.

Next steps

Transfer dollars to Inherited Roth IRA, under your name.

If there are multiple beneficiaries you must establish a separate account by 12/31 in order to use your own life expectancy for Required Minimum Distributions (RMDs). Otherwise RMDs will be based off the life expectancy of the oldest beneficiary.

When is the money available?

Able to access dollars at any point, any earnings are generally tax-free if the five-year holding period has been met. Here are some distribution options:

Distribute the Roth IRA in 5 years, by Dec 31st of the fifth year since the retirement account owner’s death.

Take distributions over your life expectancy.

Take distributions over life expectancy of original owner.

Take Out Required Minimum Distributions Over the Oldest Beneficiary's Life Expectancy.

RMDs must start by 12/31 of the year after death.

Notably, the requirement for a non-spouse beneficiary to take out a minimum distribution is only a minimum requirement the beneficiary may take out more, anytime he wishes.

This might make sense when

The non-spouse beneficiary would like to stretch inherited dollars, taking distributions over their life expectancy allowing for dollars to continue to grow tax deferred.

The non-spouse beneficiary is older than the original owner (who was not 70 ½ at death), it’s more appealing to use the decedent’s longer life expectancy.

Option 2: Lump Sum Distribution

Benefits

No 10% early withdrawal penalty.

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

Dollars available at once.

Any earnings are generally tax-free if the five-year holding period has been met.

This might make sense when

You have an immediate need for the funds.

Qualified Retirement Plan (401(k), 403(b), etc.)

Option 1: Transfer assets to an Inherited IRA

Benefits

Dollars can continue to grow tax-deferred.

No 10% early withdrawal penalty for distributions.

Designate your own beneficiaries.

Next steps

Transfer dollars to Inherited IRA, under your name. This must be done so as trustee-to-trustee transfer, where the distribution check is made payable directly to the new inherited IRA account; if the beneficiary takes possession of money, it is permanently and irrevocably distributed and ineligible for rollover.

If there are multiple beneficiaries you must establish a separate account by 12/31 in order to use your own life expectancy for Required Minimum Distributions (RMDs). Otherwise RMDs will be based off the life expectancy of the oldest beneficiary.

When is the money available?

Able to access dollars at any point dollars withdrawn will be considered taxable income. Here are some distribution options:

Distribute the Roth IRA in 5 years, by Dec 31st of the fifth year since the retirement account owner’s death.

Take distributions over your life expectancy.

Take distributions over life expectancy of original owner.

Take Out Required Minimum Distributions Over the Oldest Beneficiary's Life Expectancy.

RMDs must start by 12/31 of the year after death.

Notably, the requirement for a non-spouse beneficiary to take out a minimum distribution is only a minimum requirement the beneficiary may take out more, anytime he wishes.

This might make sense when

The non-spouse beneficiary wants more flexible distribution options than in the Qualified Retirement account.

The non-spouse beneficiary would like to stretch inherited dollars, taking distributions over their life expectancy allowing for dollars to continue to grow tax deferred.

The non-spouse beneficiary is older than the original owner (who was not 70 ½ at death), it’s more appealing to use the decedent’s longer life expectancy.

Option 2: Lump Sum Distribution

Benefits

No 10% early withdrawal penalty.

Next steps

Transfer assets to bank account or brokerage account.

When is the money available?

Dollars available at once.

Taxable portion of the distribution will be considered taxable income.

The distribution will be subject to a mandatory 20% Federal Tax withholding (possible additional state tax will be withheld).

This might make sense when

You have an immediate need for the funds.

In a season of loss, remember Human Investing is here to help navigate this difficult time.

Sources: www.irs.gov www.schwab.com

Related Articles

This article was originally published on Forbes.

Shutterstock

The Employee Retirement Income Security Act (ERISA) was established in 1974 to give employees retirement income security. Why, then, after 40-plus years, are Americans so underprepared for retirement?

According to a 2015 study from the Government Accountability Office, "About half of households age 55 and older have no retirement savings (such as in a 401(k) plan or an IRA)." Even those who have saved have saved poorly. Among those households of residents ages 55 to 64 with some retirement savings, the median amount saved is $104,000. For those 65 to 74, the amount is roughly $148,000 per household. And, with 70% of the civilian population having access to a retirement plan and 91% access for government employees, it’s a wonder there is such a lack of retirement readiness.

There is no shortage of financial and intellectual capital being spent on a solution for retirement readiness. But most solutions have fallen short of narrowing the gap between the retirement haves and have-nots. So, what is the solution? My thoughts follow:

Government Plus Employer Plus Employee

First, the government is already involved in the regulation of retirement plans, as well as allowing for employers to deduct the expenses of having a plan, so why not go all in? Why not tell employers, “If you are going to get the deduction, you need to meet certain requirements that are great for employees, great for your business and great for our country”?

Those requirements could include auto-enrollment (as this has been a home-run for participation), auto-increase (as individuals get raises, they add a little more to their retirement) and an eligible age-based default option (eligibility for a great default option would be low-cost and diversified as you get from the likes of popular mutual fund providers with their index retirement glide path funds).

In order to qualify for a business deduction or incentive from the government, an employer would be required to match a certain amount. I’d propose 5%, with the employee required to commit 5% to get that amount. Why these amounts? Because if someone has a job for 40 years and invests in a basket of mutual funds growing at or around 8%, with both the employee and employer contributing at 5% each, they end up a millionaire (assuming a $36,000 annual salary, or $300 per month contributions, compounded monthly for 40 years.)

The Industry

In a recent Society for Human Resource Management (SHRM) study, more than 70% of HR professionals surveyed emphasized the importance a retirement savings plan. So, at a minimum, employees are aware of the need to save and desire to do so. While there is definitely a need amongst employees to save for retirement, there are several barriers that impact participants interest and willingness to save. First, trust among advisors is low. Second, many plans have a dizzying array of options, which negatively impacts deferral rates. Finally, not all employers offer to match contributions, which minimizes the incentive for employees to contribute to the 401(k) versus less automated choices, like an IRA.

So, what can the industry do to partner with employers and their workforce? There are two things in my view:

1. Understand the heart of ERISA. Advisors and their firms are to put the interests of the employee and their income security at the center of everything they are doing. If, somehow, the advice we are giving in any way conflicts with the employee and their security, then we should reassess what we are doing and meet the stated purpose of ERISA -- it doesn’t need to be any more complex.

2. In order to minimize the potential for anything but the fiduciary standard, any firm operating in the retirement space should be required to be a fiduciary and have no ability to be dually registered or receive commissions, kickbacks, trips or any other super-secret benefit.

Join the small percentage of firms that are truly fee-only and have no way of receiving any form of compensation other than from the client. Disclosing away conflicts is not the answer for the clients, as few read the disclosures they are provided. If we are going to serve clients well, eliminating the ability for the conflict to exist is the only reasonable route to go.

In conclusion, the government is already involved in both rule-making and incentives for companies and their employees to offer and invest in retirement plans. A model for offering a retirement plan that meets certain criteria in order to fully receive the incentive should be outlined and adhered to by companies and their employees. In partnership with the government, employers and employees, the financial services community should be held to a higher standard to eliminate the conflicts that keep retirement plans for becoming all they could be, which is for employee retirement income security.