Social Security is something we contribute to all our working years, so why don’t we know much about it? What sets it apart from other retirement benefits? I want to briefly share some of the characteristics that make Social Security unique and helpful for retirement planning purposes.

Social Security Includes Spousal Benefits

Social Security spousal income is a benefit provided to married couples. If you have a working income that is less than 50% of your spouse’s normal retirement age benefit, a spousal benefit will be added to your Social Security income to make it equal to 50% of your spouse’s income. Even with no working income (homemaker), 50% of the spouse’s normal retirement age income will be received.

To receive this increase in income, the higher-earning spouse must start their benefits before the spousal payments begin. Check your eligibility for spousal benefits here.

Two more things to note:

There is no benefit to delaying spousal income after normal retirement age as it does not continue to grow.

If the spouse with the higher income predeceases the spouse with the lower income, the surviving spouse will receive the higher of the two incomes for the rest of their life. For example, let’s say Joe has a social security benefit of $2,800 per month, and his wife, Shirley, has a benefit of $1,400 monthly. At Joe’s death, Shirley will receive $2,800 per month rather than $1,400 per month.

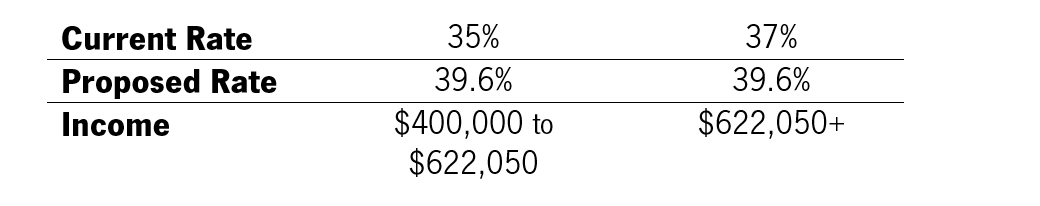

Social Security income is not fully taxable

If you are Married Filing Jointly and have a combined income below $25,000 in 2021, you will not owe taxes on social security benefits. If your income is between $25,000 and $34,000 in 2021, 50% of benefits will be subject to taxation. With income over $44,000 in 2021, a maximum of 85% of benefits will be taxable. Social security income is not subject to Oregon state income tax.

Social Security Income varies based on retirement age

You can start taking social security retirement benefits at the age of 62, but if you are able, it is best to delay taking benefits until normal retirement age (typically age 66). Furthermore, delaying benefits until the age of 70 is even more advantageous, as your income will continue to increase by a certain percentage (based on birth year) until then.

Remember: If benefits are claimed before normal retirement age, half of the benefits will be withheld if income is over $18,960. Benefits will be recalculated at normal retirement age, but it is more beneficial to delay taking social security if someone is planning to work. After reaching normal retirement age, unlimited earned income will not reduce your social security income.

Social Security Income is protected from inflation

Each January the IRS/SSA increases benefits by the amount of inflation experienced over the previous year. These cost-of-living adjustments (COLA’s) are credited even when delaying benefits to a later age. The most recent cost of living adjustment was 1.3% in January 2021. The average estimates over a long period of time are 2.6% annually.

Things to note when applying for benefits:

Ensure you have Federal withholdings taken from your benefits, often at 12%.

Remember, your Medicare Part B premiums ($148.50 per check) will be deducted from your benefit if you are over age 65.

Apply online at www.socialsecurity.gov, by phone at (800) 772-1213, or in person at a Social Security office using the office locator. If you have any questions about social security benefits, please schedule a time to chat.

References:

The Baby Boomer’s Guide to Social Security, Elaine Floyd, CFP®